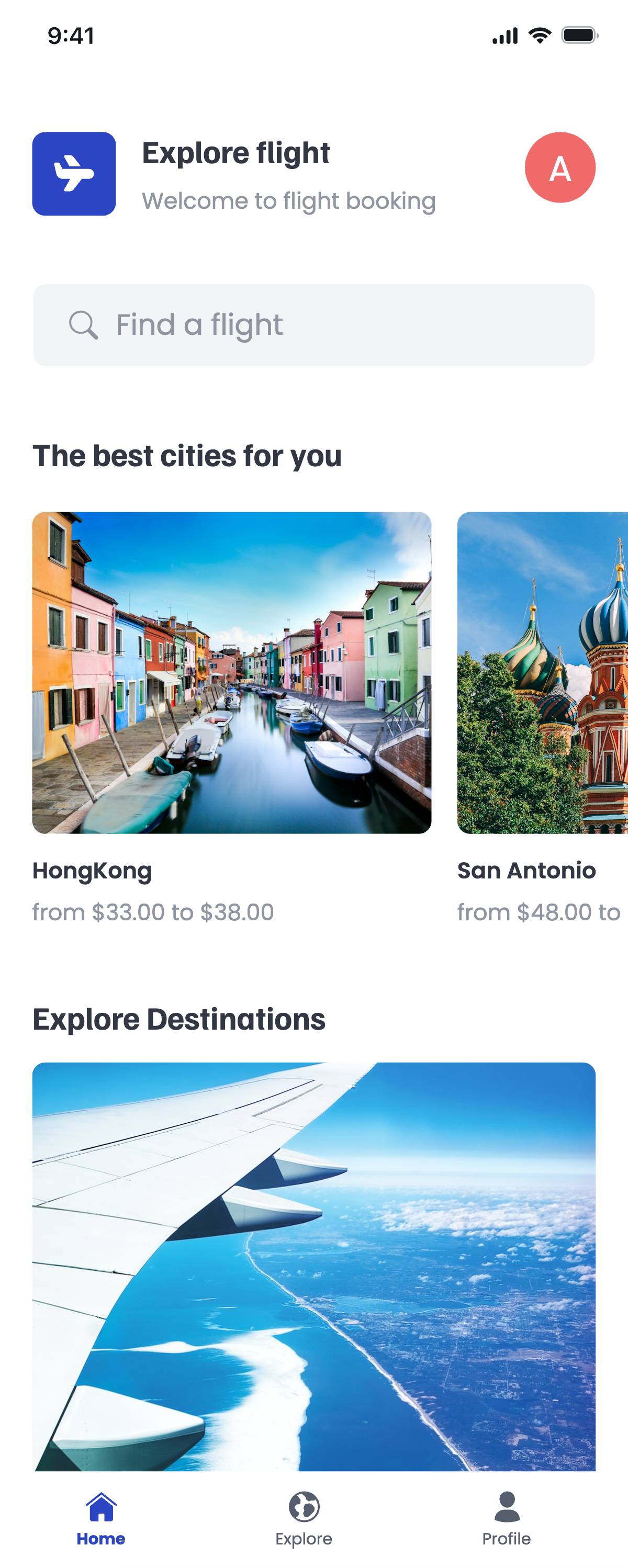

Flight Booking App Template

Use Visily's Flight Booking App Template and customize it the way you want

Flight Booking App Template for Your Travel Business

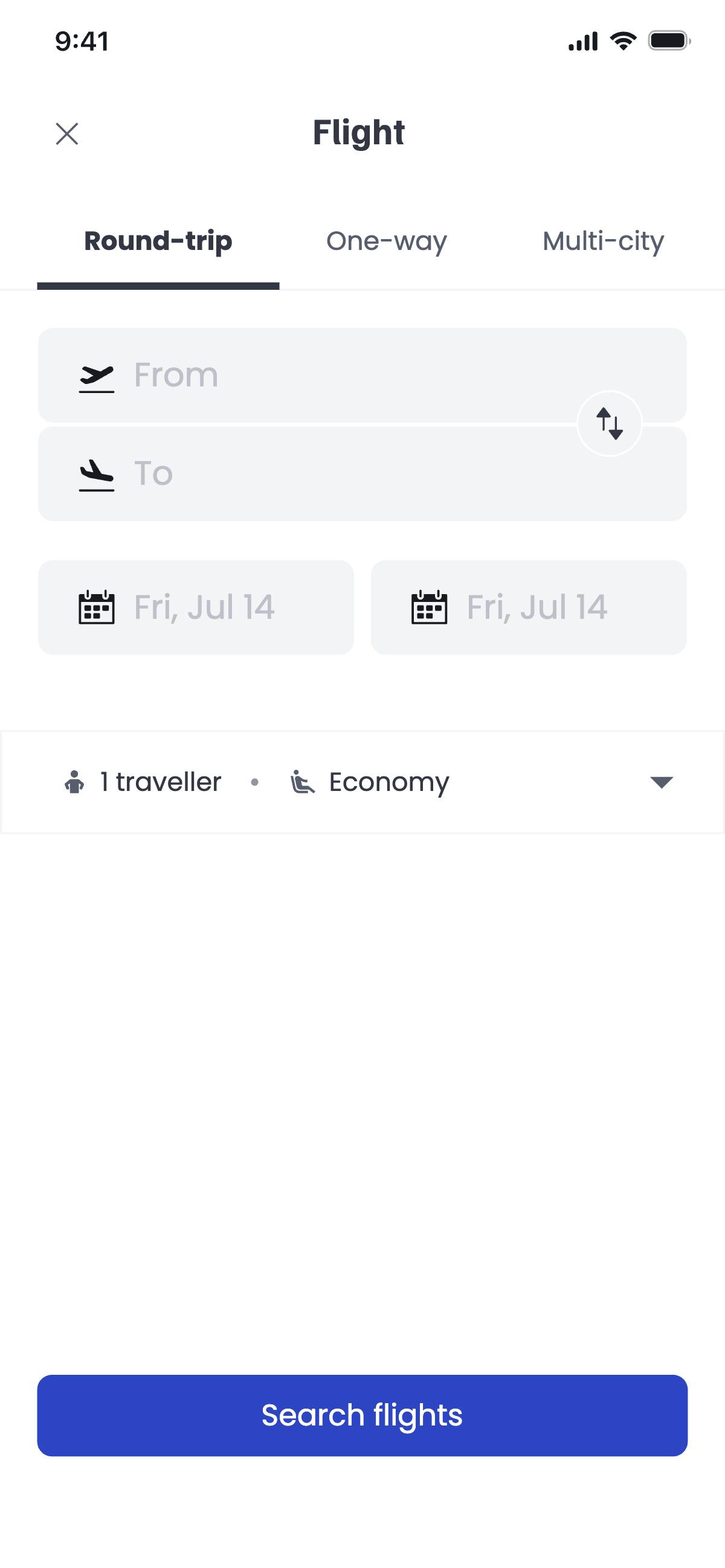

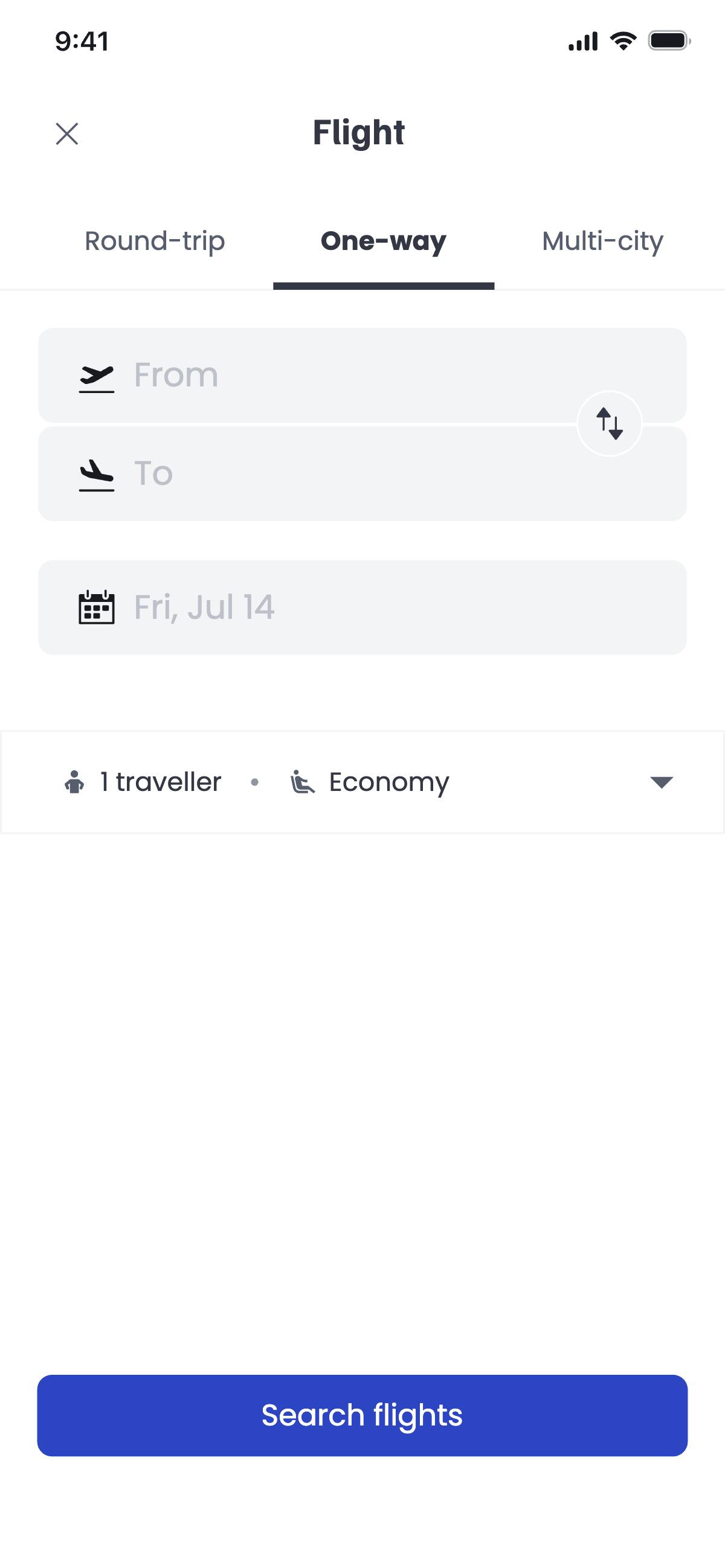

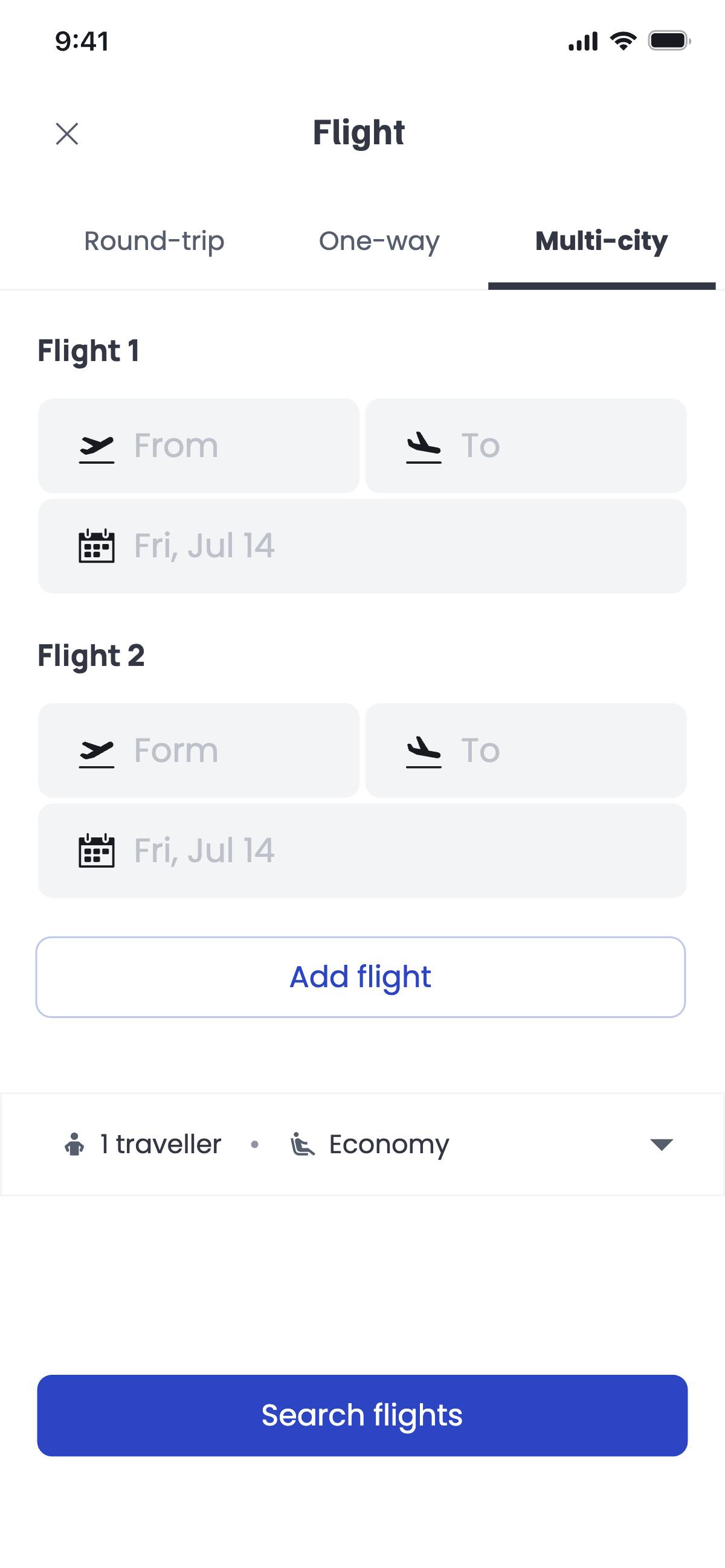

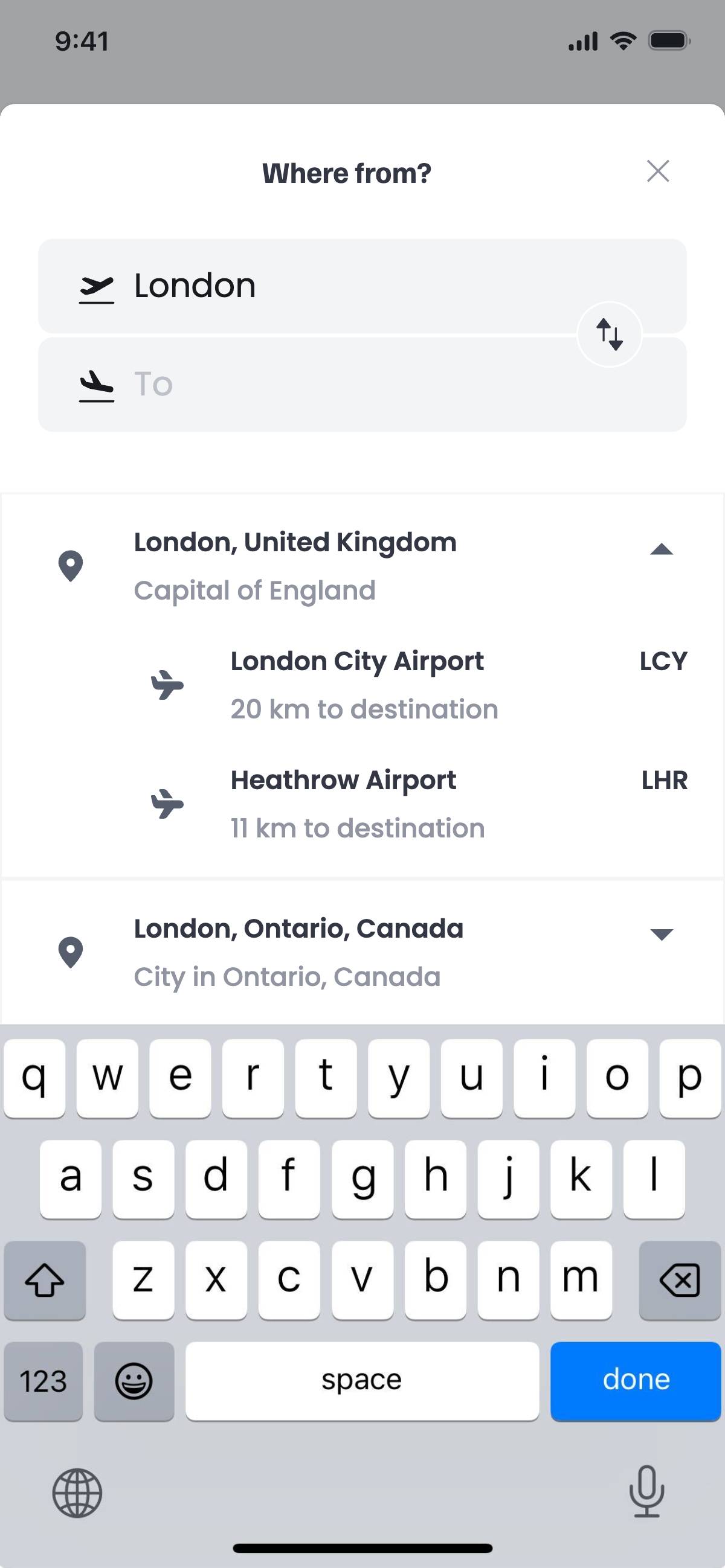

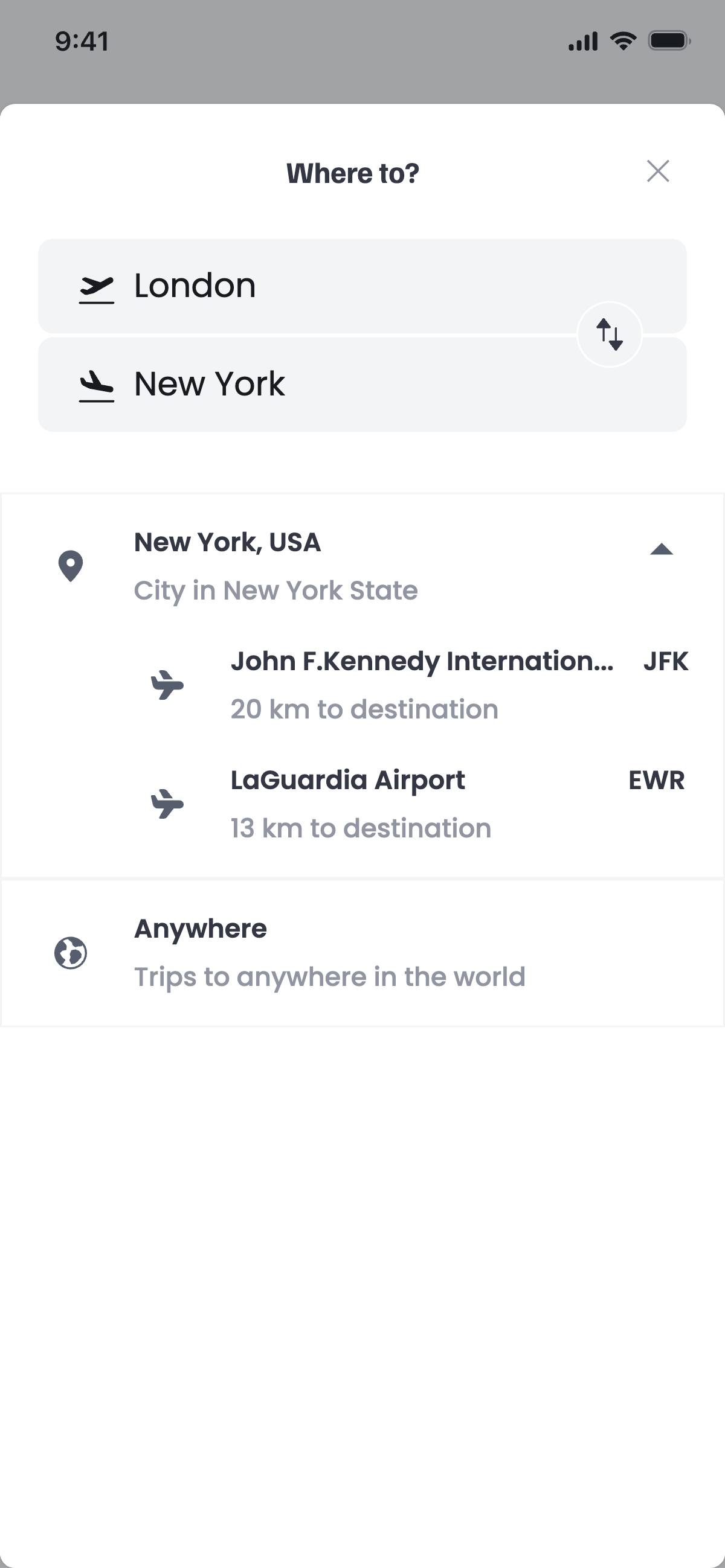

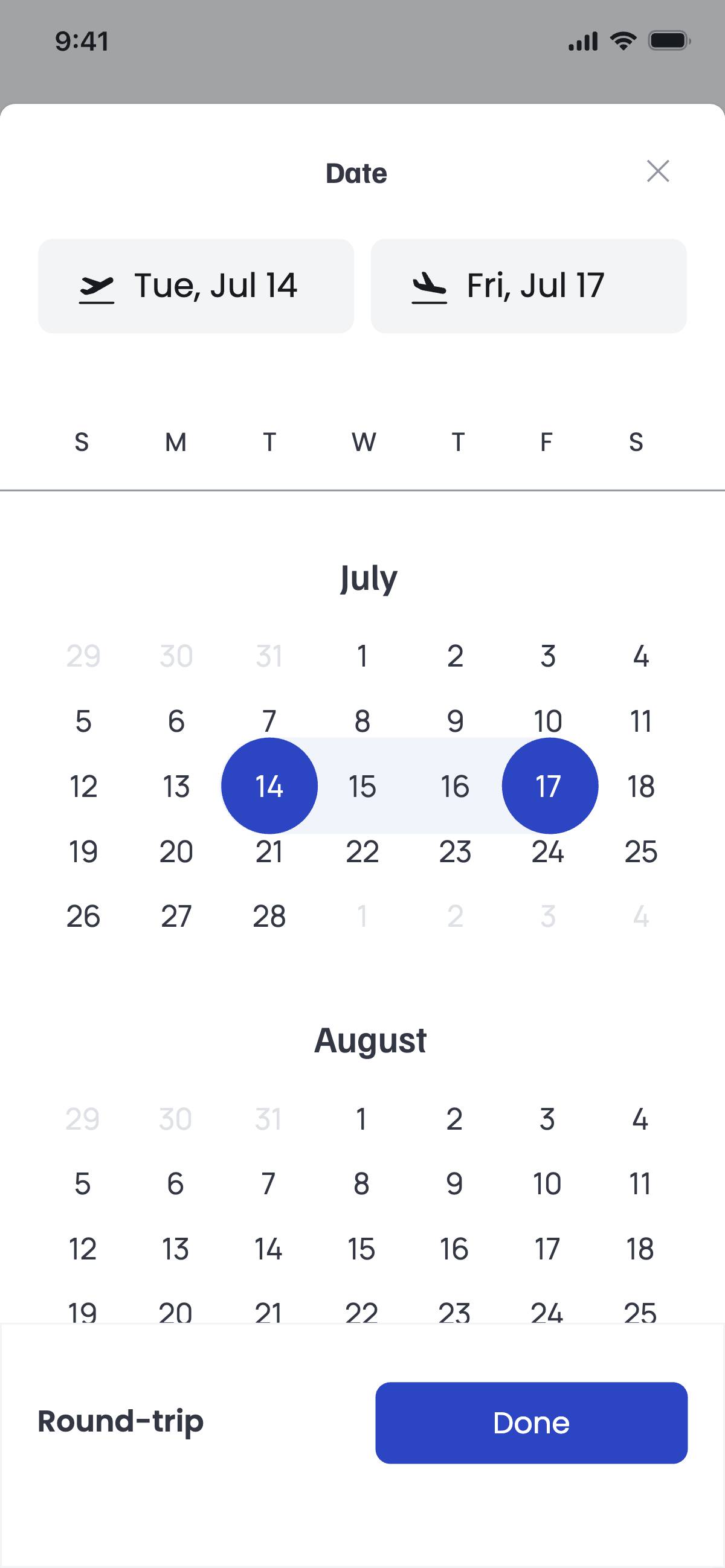

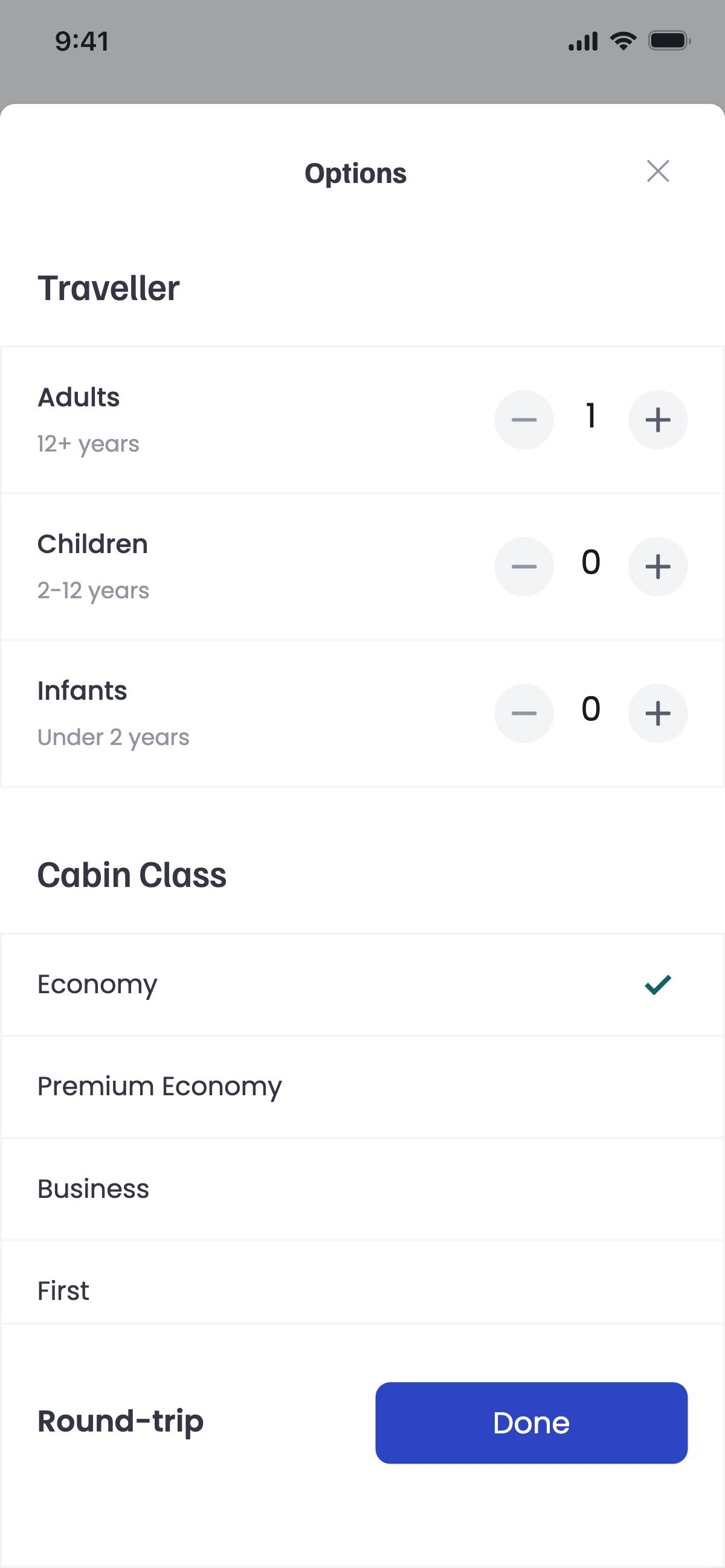

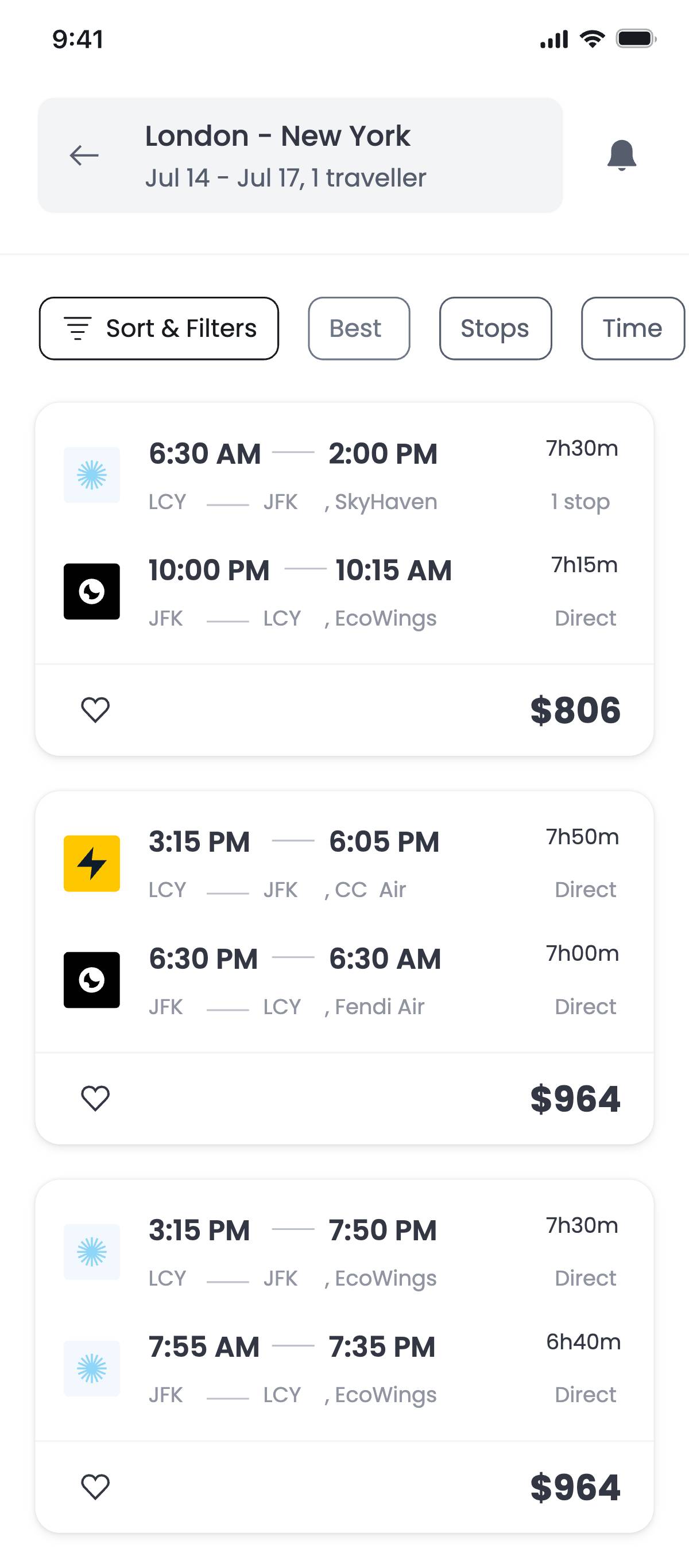

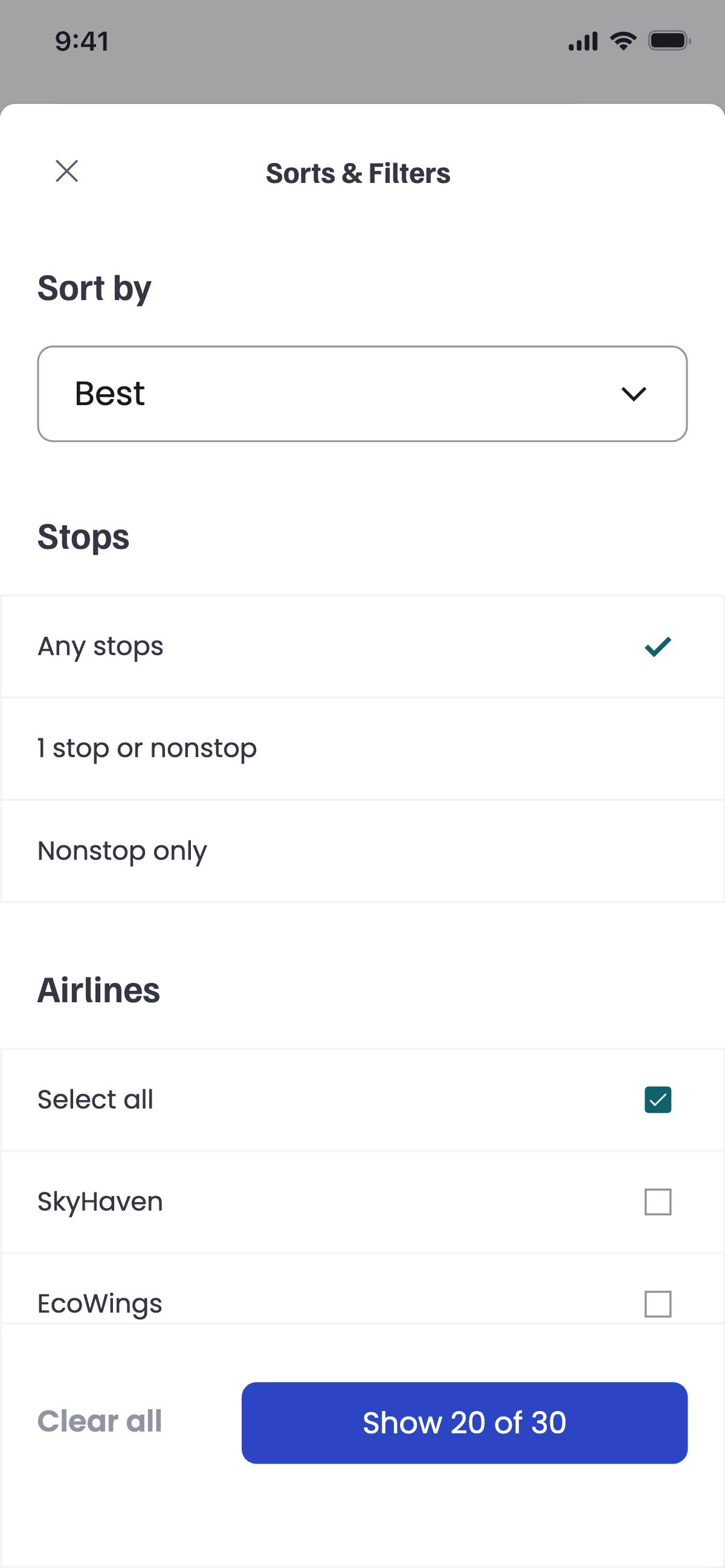

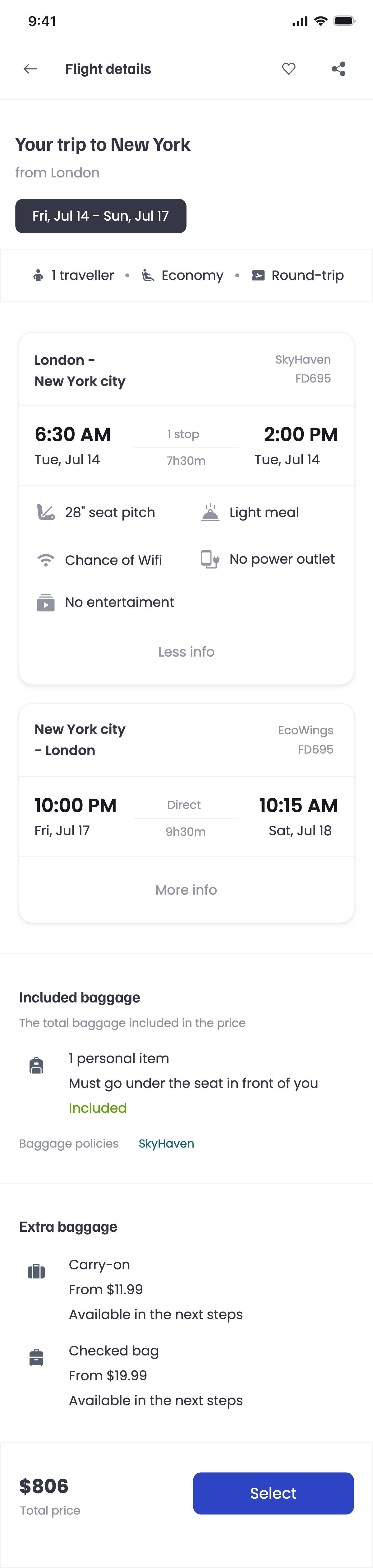

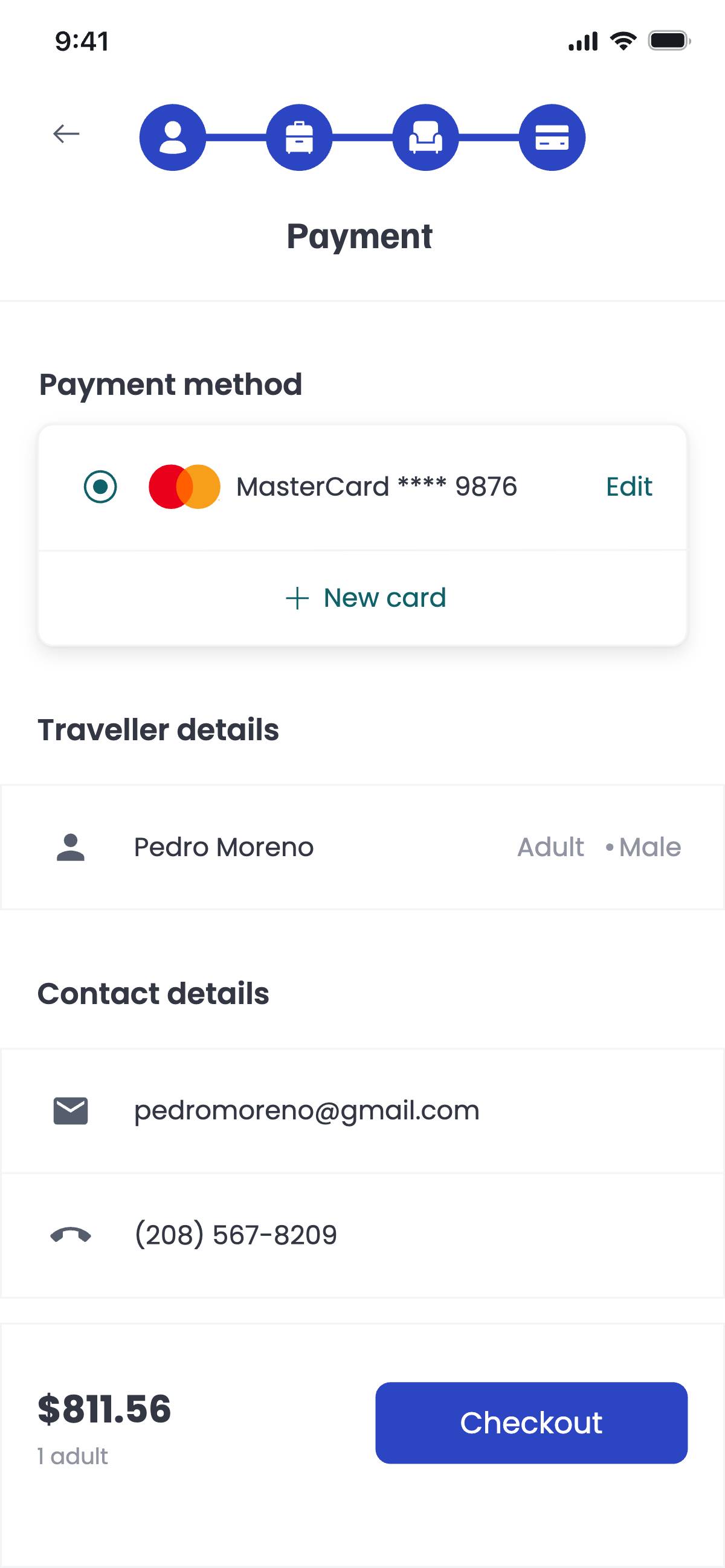

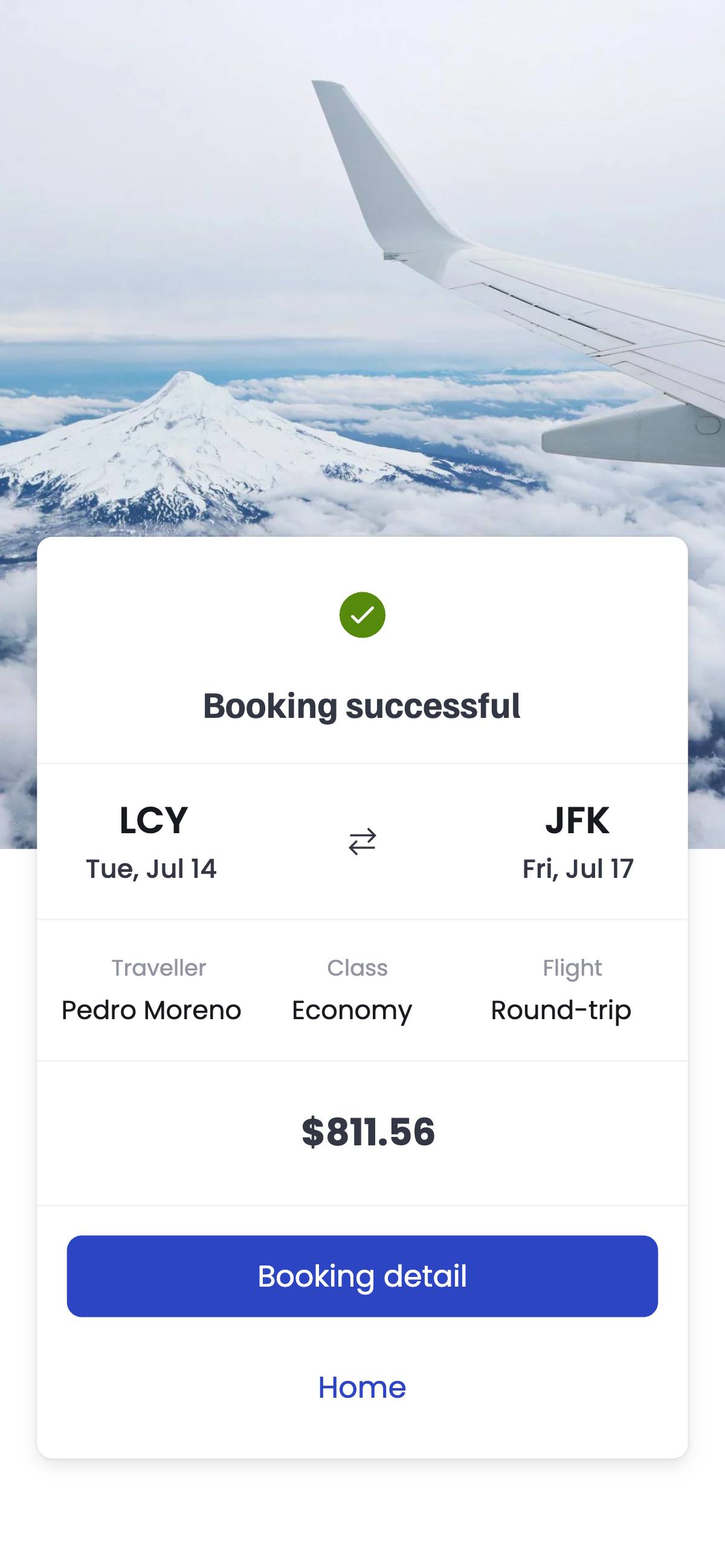

Visily's Flight Booking App Template is the perfect solution for travel agencies, airlines, or any business in the travel industry looking to provide a seamless and user-friendly platform for flight bookings. This template is designed to facilitate easy search and booking of flights, provide flight details, and enhance the overall flight booking experience.

Why Choose Visily's Flight Booking App Template?

Fully Customizable

Every travel business has its unique style and audience. That's why our Flight Booking App Template is fully customizable. You can adjust everything from the layout to the color scheme, ensuring that your app truly reflects your brand's identity and appeals to your target audience.

Saves Time and Effort

Creating an app from scratch can be a complex and time-consuming task. Our template provides a solid foundation, allowing you to focus on what truly matters - your flights and customers. With our template, you can quickly set up a professional and user-friendly flight booking app.

Align with Your App's Brand

Our template allows you to easily modify the colors, fonts, and styles to match your app's brand. This ensures that your app is not only functional but also visually appealing and consistent with your brand's identity.

Designed with Best Practices

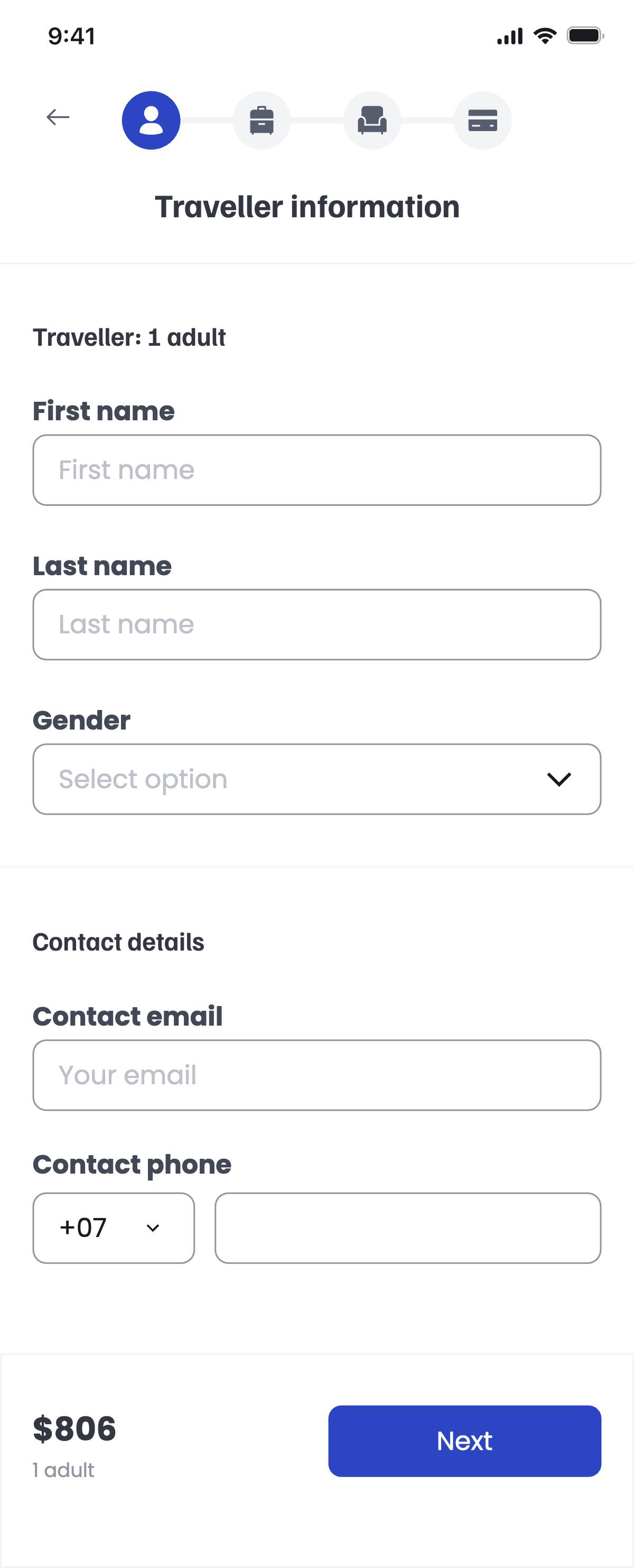

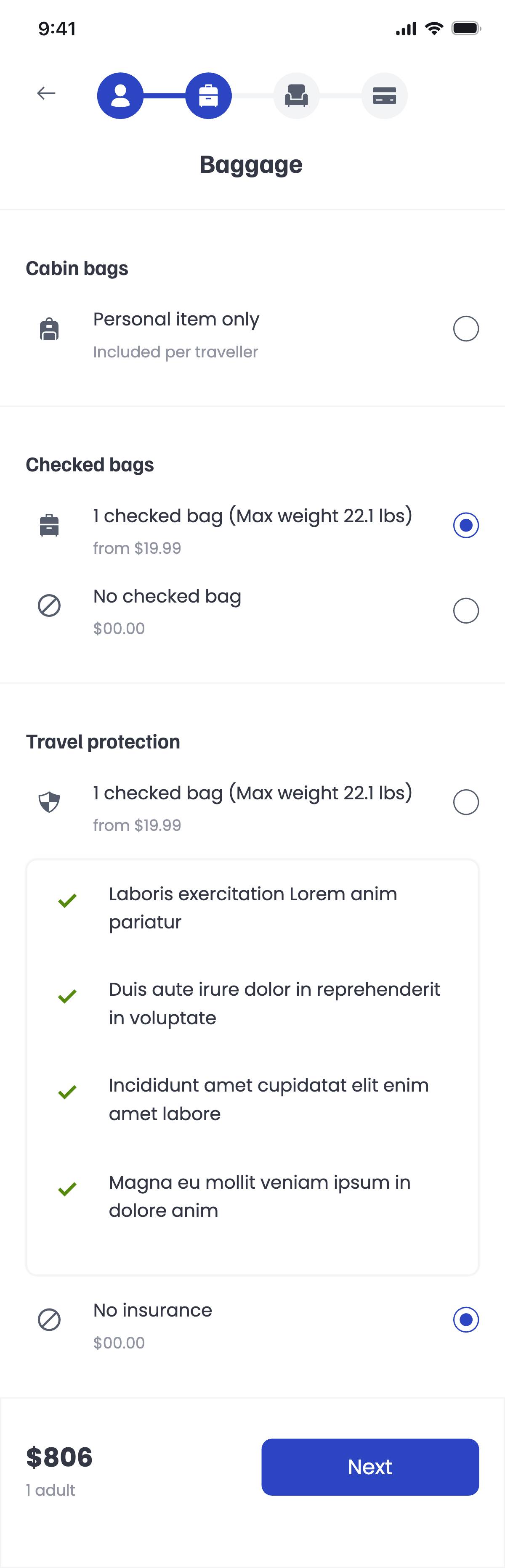

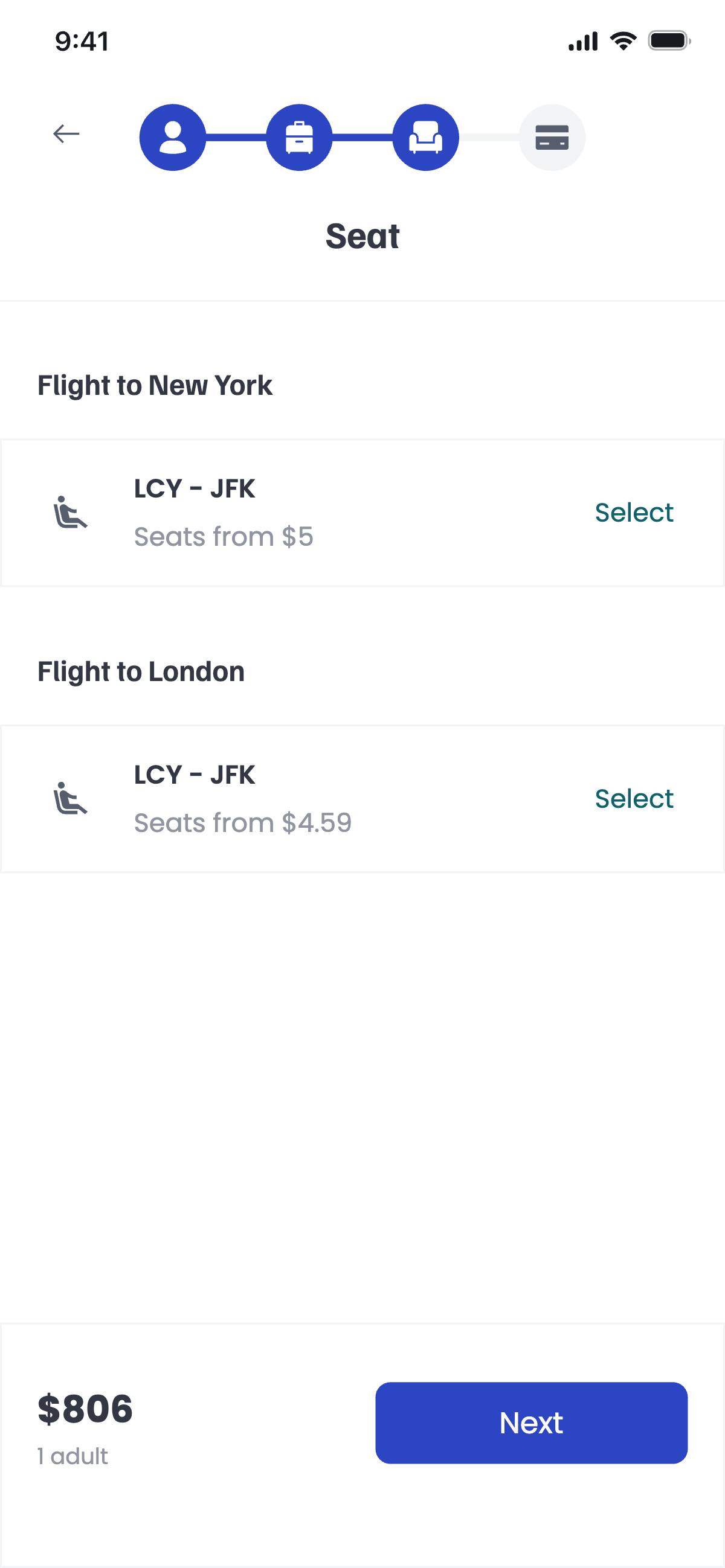

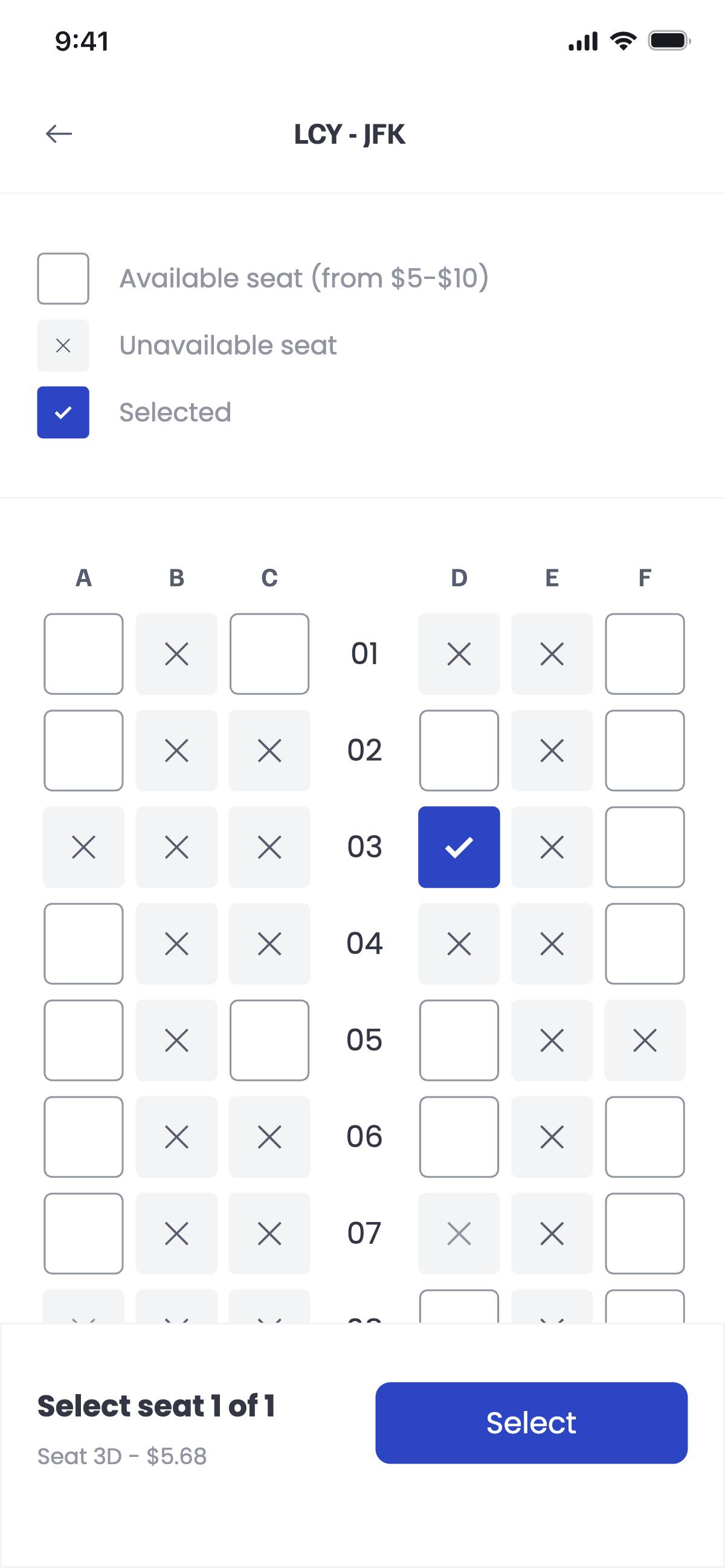

Our Flight Booking App Template includes all the essential elements of a flight booking app, designed with best practices in mind. This includes sections for flight search, flight details, booking process, and secure payment processes.

How to Use Visily's Flight Booking App Template?

1. Click the "Use this template" button to get started.

2. Sign up for a Visily account to access all our customization features.

3. The template will be pre-loaded on your design canvas, ready for customization.

4. Use Visily's user-friendly editor to customize your design to your liking.

Create stunning designs in a click

Visily's combination of power and simplicity lets anyone design beautiful UI.