Brainstorming tools

to inspire your creations

to inspire your creations

Spark your next product ideas

Ideate and iterate them into stunning wireframes, right inside of Visily!

Let your ideas flow

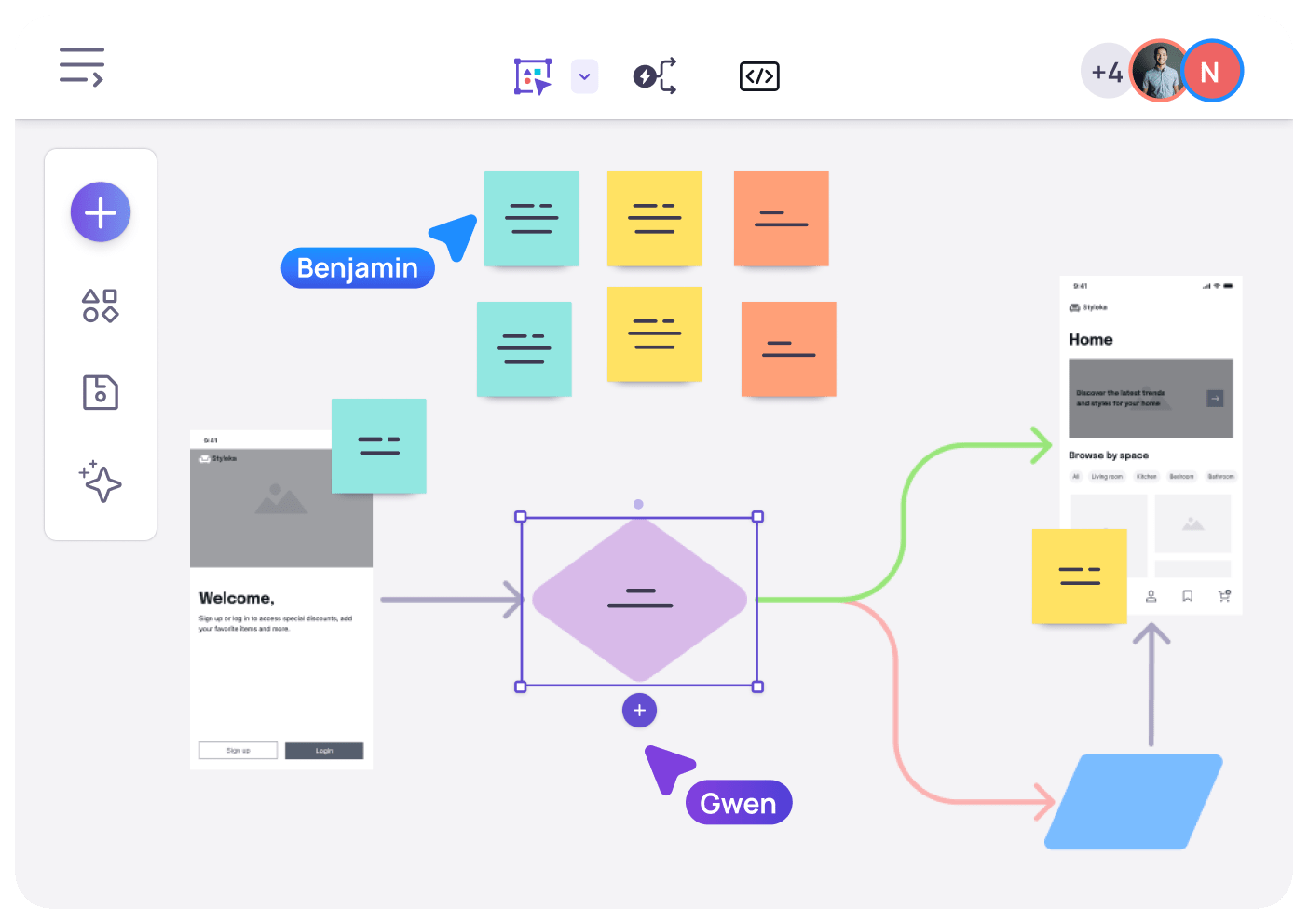

Brainstorm & refine ideas through diagram & note tools

Brainstorm & refine ideas through

diagram & note tools

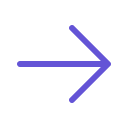

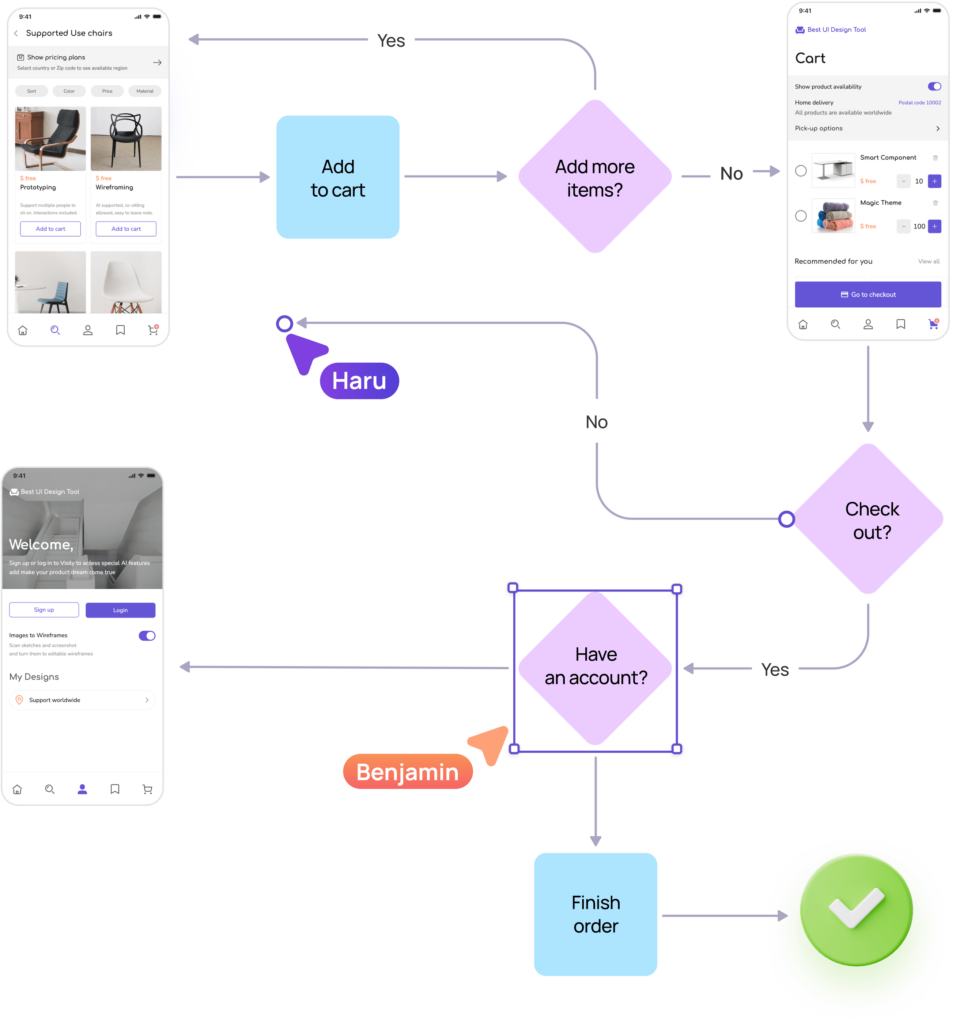

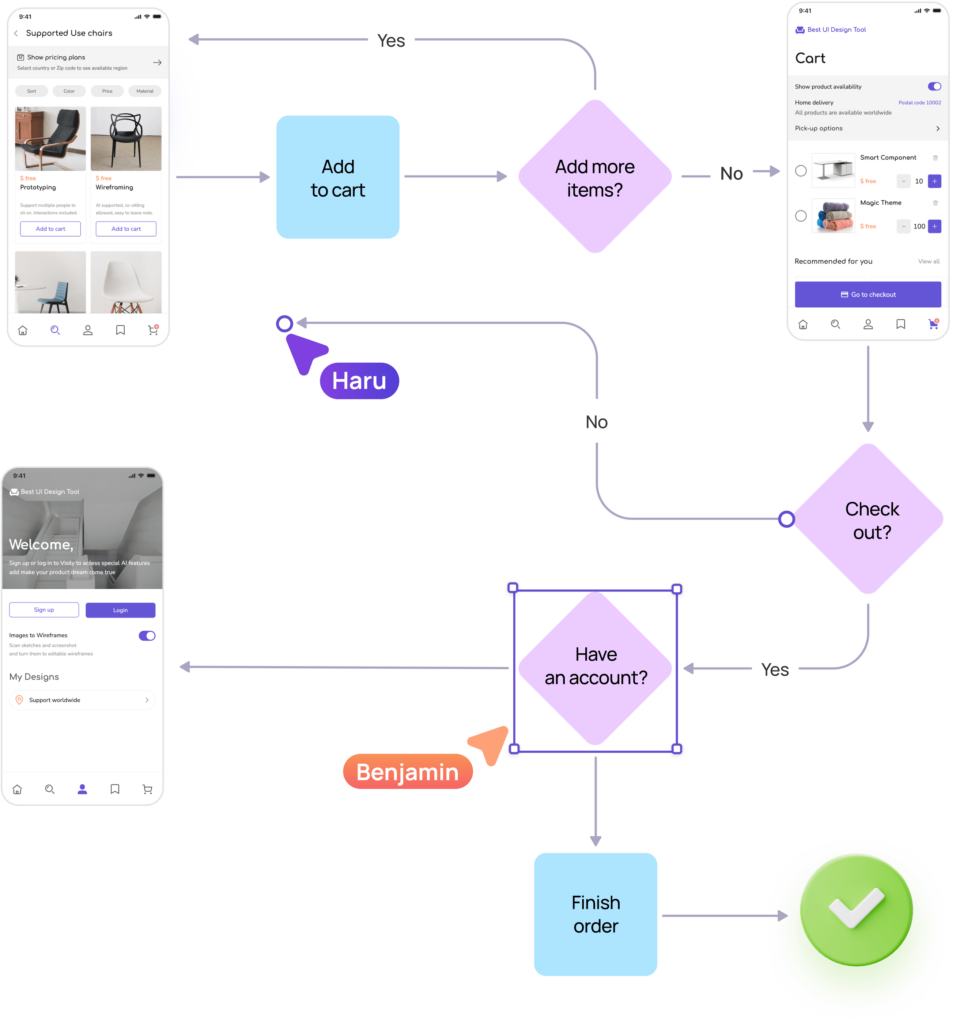

Quickly design flows & processes

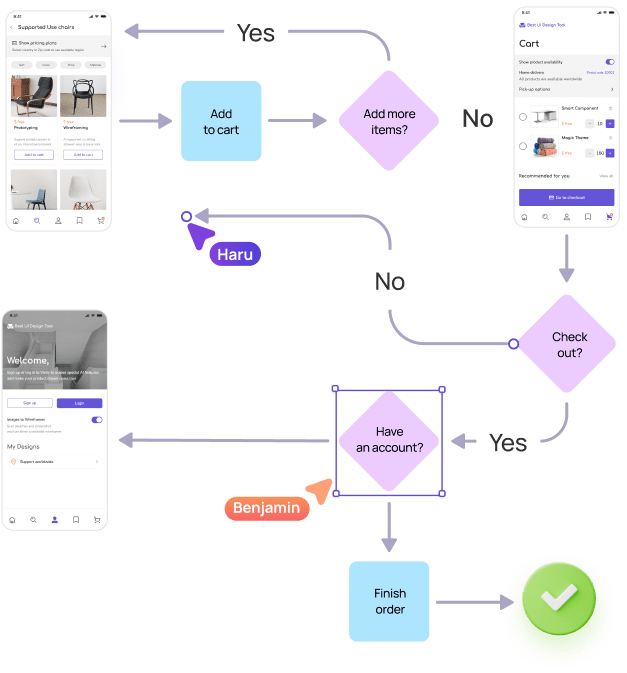

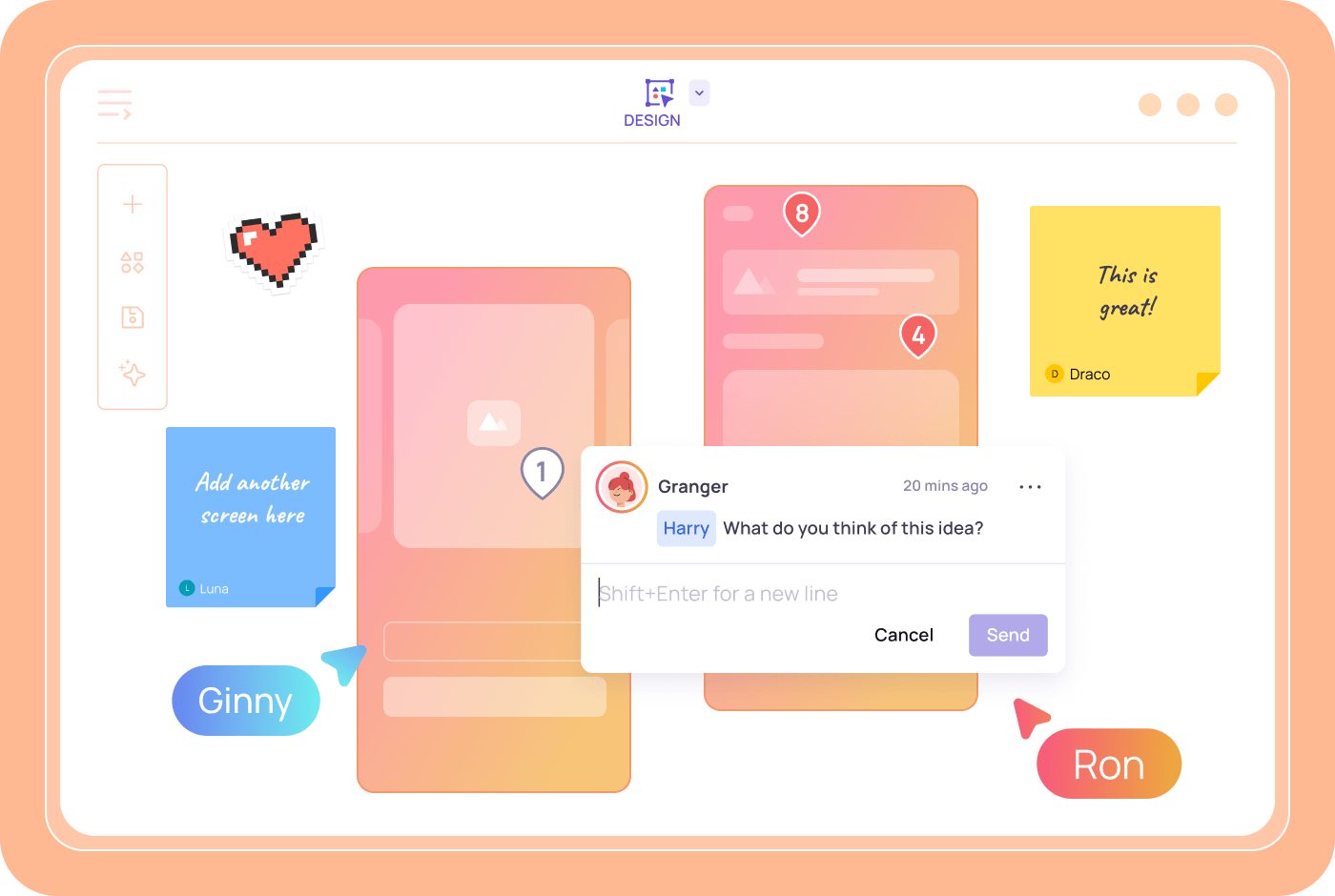

Leave notes, reminders,

or feedback on any design

Quickly design flows & processes

Leave notes, reminders,

or feedback on any design

Beta

Text to Diagram AI

Convert your ideas into intuitive designs

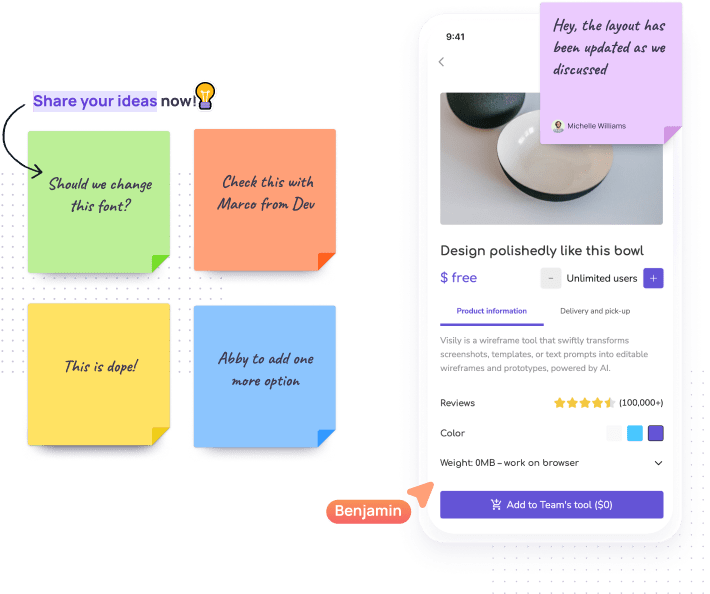

Collaboration doesn't end with brainstorming!

Turn your ideas into wireframes in a blink of an eye right within Visily.

Turn your ideas into wireframes in a blink of an eye right within Visily

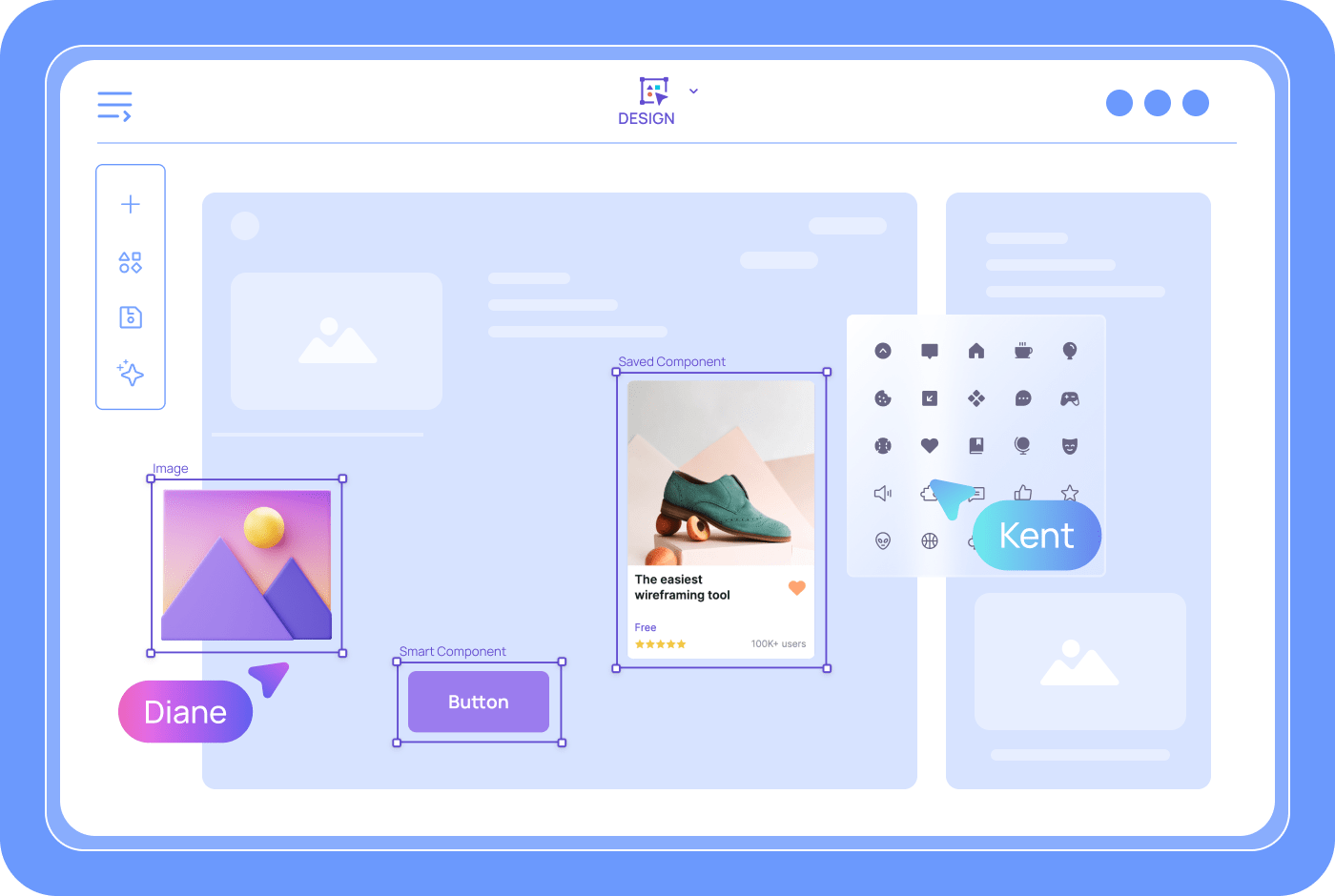

Screenshot to Design AI

Generate beautiful, fully editable wireframes from a single image or screenshot.

With the browser extension you can quickly use or save any ideas you see!

Screenshot to Design AI

Coming soon

Text to Design AI

Coming soon

Text to Design AI

Describe your ideas using plain text and let our AI turn them into a series of sleek designs.

1,500+ templates

Pick from over 1,500 completely customizable Visily templates to bring your vision to life!

1,500+ templates