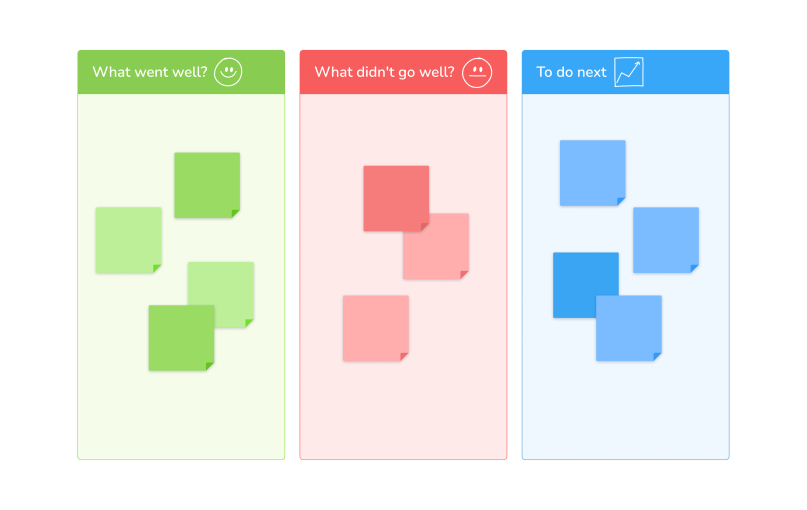

Sprint Retrospective Template

Use Visily's Sprint Retrospective Template to review both successes and failures to enhance daily practices

About the Sprint Retrospective Template

Conduct effective and actionable sprint retrospectives with Visily's Sprint Retrospective Template. This pre-designed, fully customizable template facilitates open team discussion, encourages continuous process improvement, and fosters agile workflows.

How to Use Visily's Sprint Retrospective Template

1. Get Started: Click "Use this Template" to access the retrospective structure.

2. Create an Account: Sign up for a free Visily account to unlock editing options.

3. Fill in and customize:

- Use the sections like "What Went Well", "What Could Be Improved", and "Action Items" to guide your discussion.

- Rearrange elements and add more sections as needed.

- Use color-coding or visual cues for better organization.

Benefits of Using Visily's Sprint Retrospective Template

- Time-saving: our templates eliminate the need to create retrospective meeting notes from scratch

- Stay Flexible: Adapt the template to fit your team's unique retrospective style.

- Collaborate better: Share notes and gather input seamlessly from the whole team.

Generic Flowchart

Use Visily's Business Messaging Website Template and customize it the way you want

Related templates

Create stunning designs in a click

Visily's combination of power and simplicity lets anyone design beautiful UI.