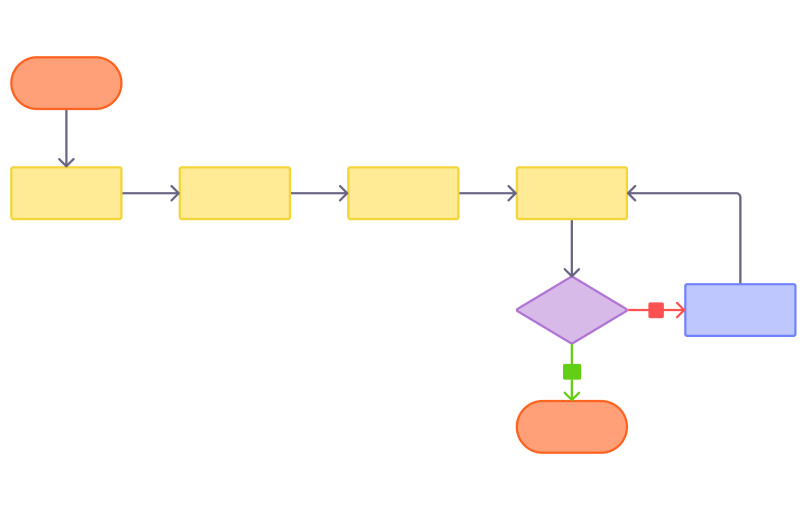

Checkout Flow Template

Build an efficient and user-friendly checkout process with this easy-to-customize Checkout Flow Template.

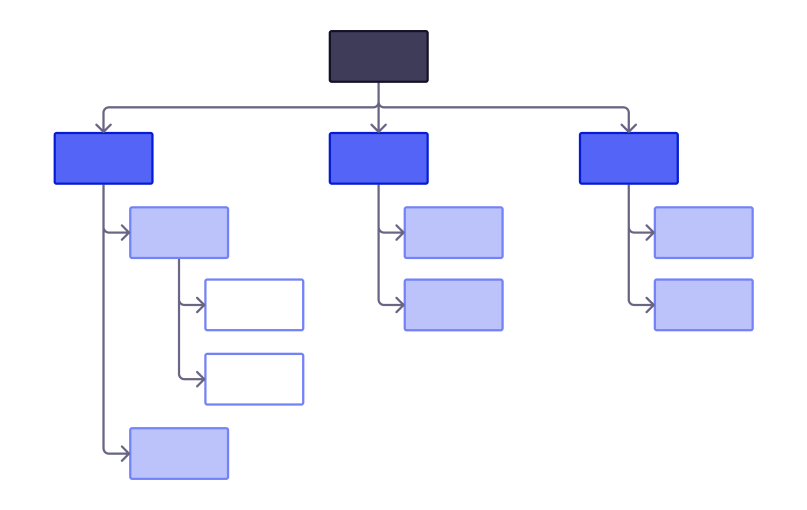

About the Checkout Flow Template

Optimize your checkout experience with Visily's Checkout Flow Template. Ensure a smooth and secure path to purchase, minimizing cart abandonment and boosting conversions. This fully customizable template simplifies the process of designing an efficient checkout flow.

How to Use Visily's Checkout Flow Template

1. Get Started: Locate the "Checkout Flow Template" and click "Use This Template".

2. Create an Account: Sign up for your free Visily account for full customization power. The template will automatically load onto your design canvas.

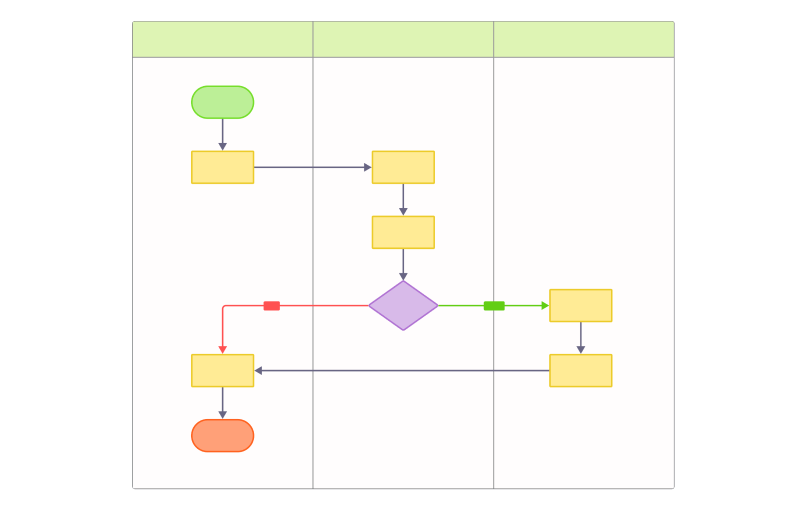

3. Fill in and customize the checkout template:

- Replace placeholder text with your relevant product information, shipping options, and payment methods.

- Add or adjust checkout steps for a seamless experience.

- Ensure your branding is aligned by customizing colors, fonts, and visuals.

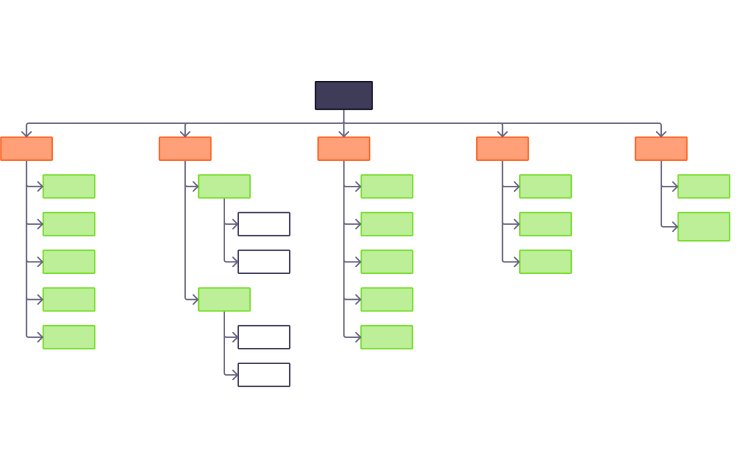

Benefits of Using Visily's Checkout Flow Template

- Save Time and Resources: Skip building checkout flows from scratch. Our template provides the perfect foundation.

- Effortless Customization: Use our intuitive drag-and-drop tools to tailor your flowchart to your precise requirements.

- Easy Collaboration: Invite your team to edit and update the flowchart in real-time, ensuring everyone stays on the same page.

Generic Flowchart

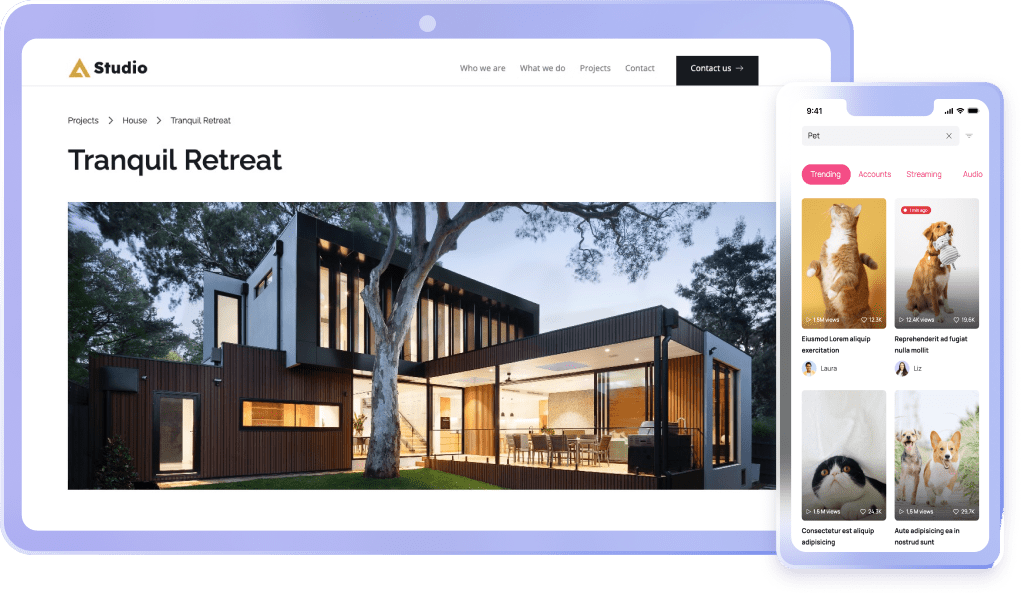

Use Visily's Business Messaging Website Template and customize it the way you want

Create stunning designs in a click

Visily's combination of power and simplicity lets anyone design beautiful UI.