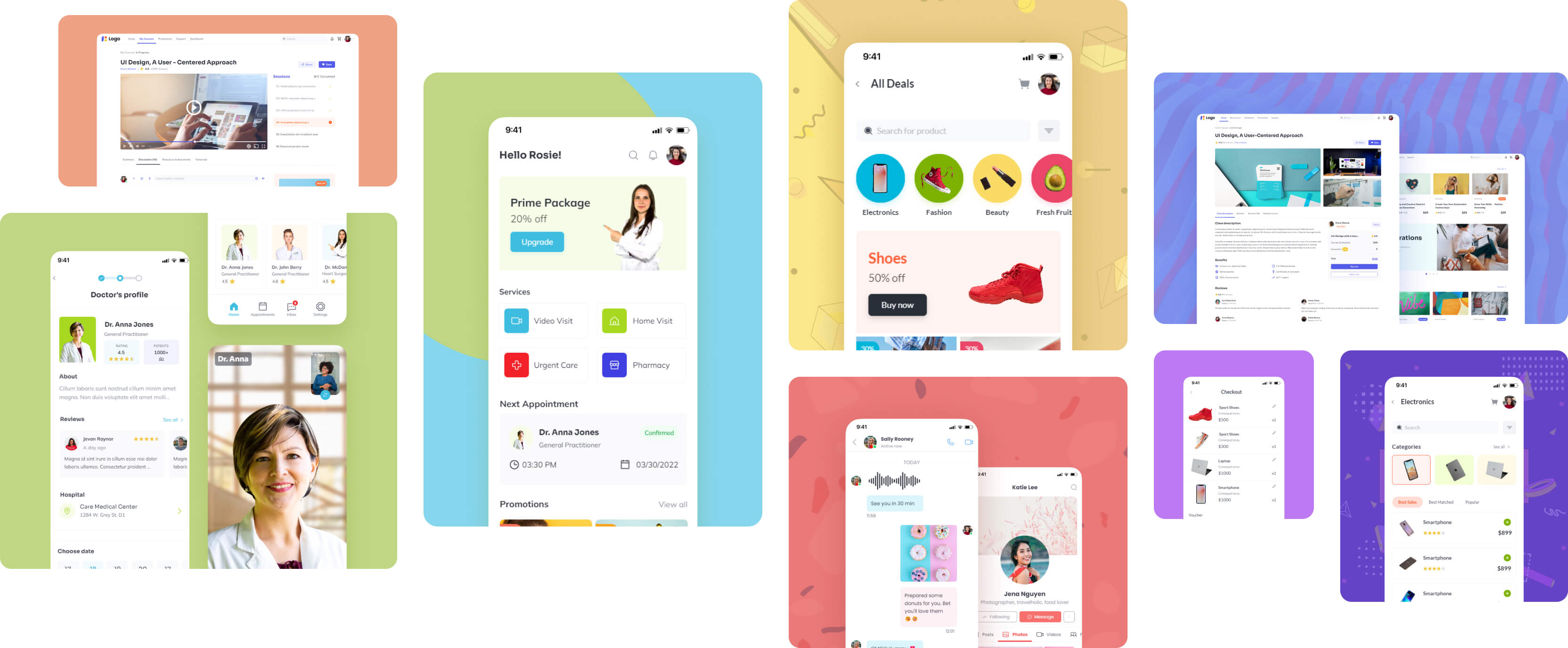

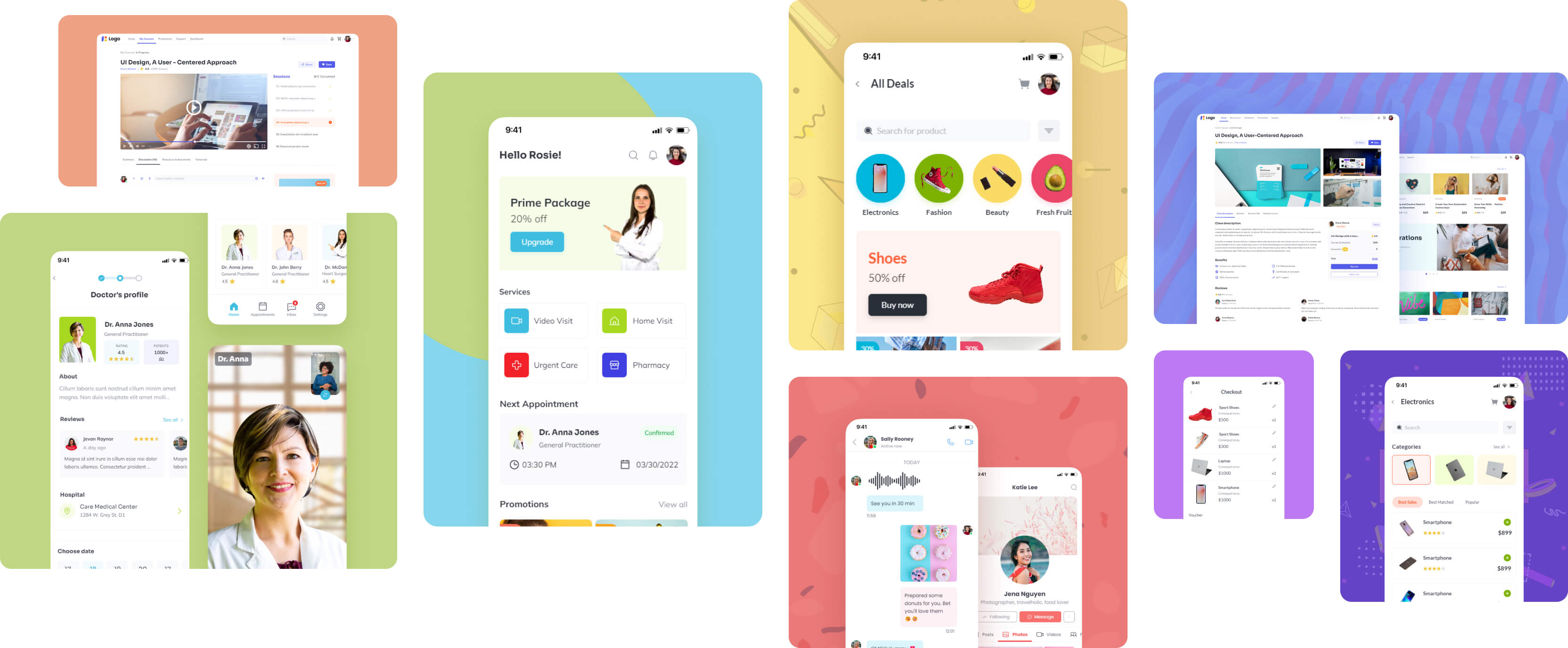

Page Templates

Hundreds of beautiful

web and mobile

app templates

web and mobile app templates

Never design app UI

from scratch again

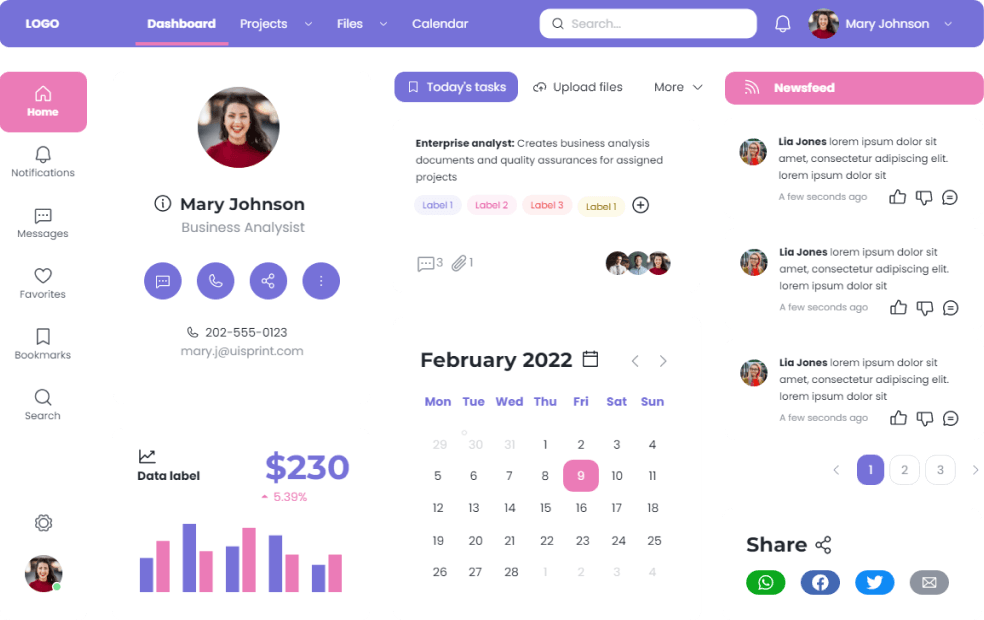

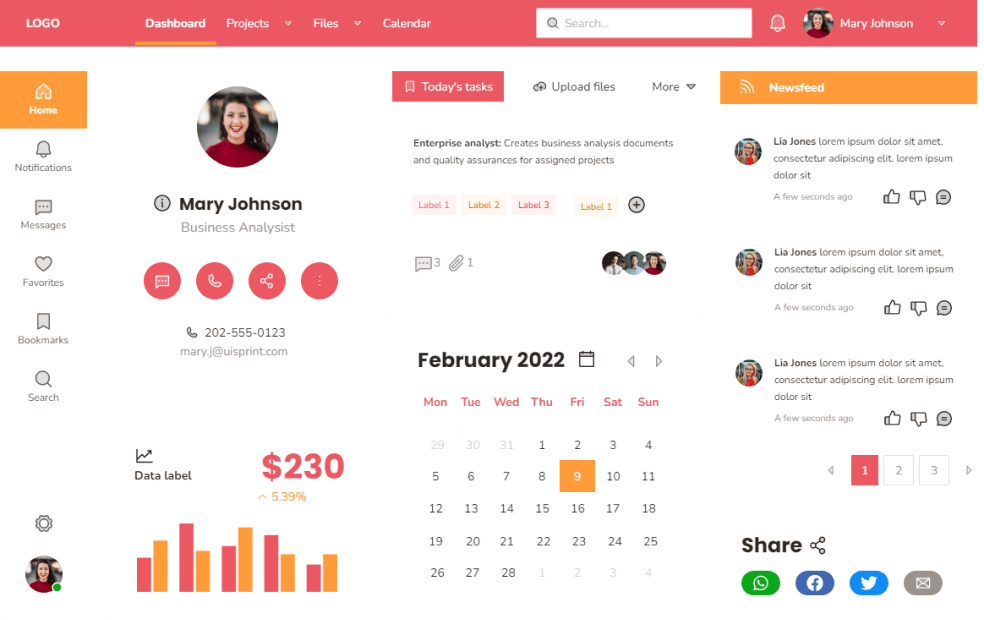

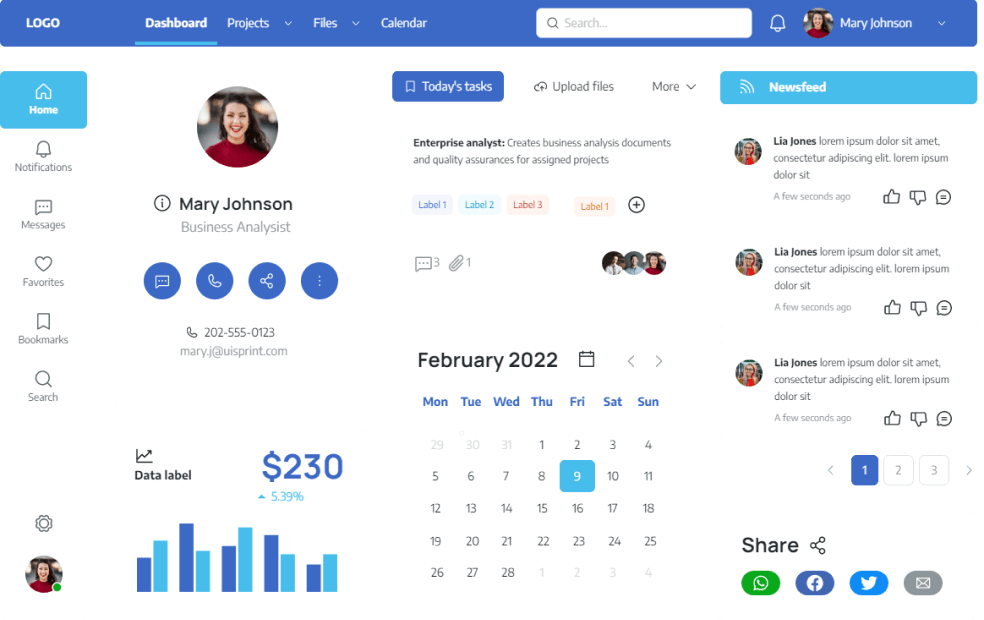

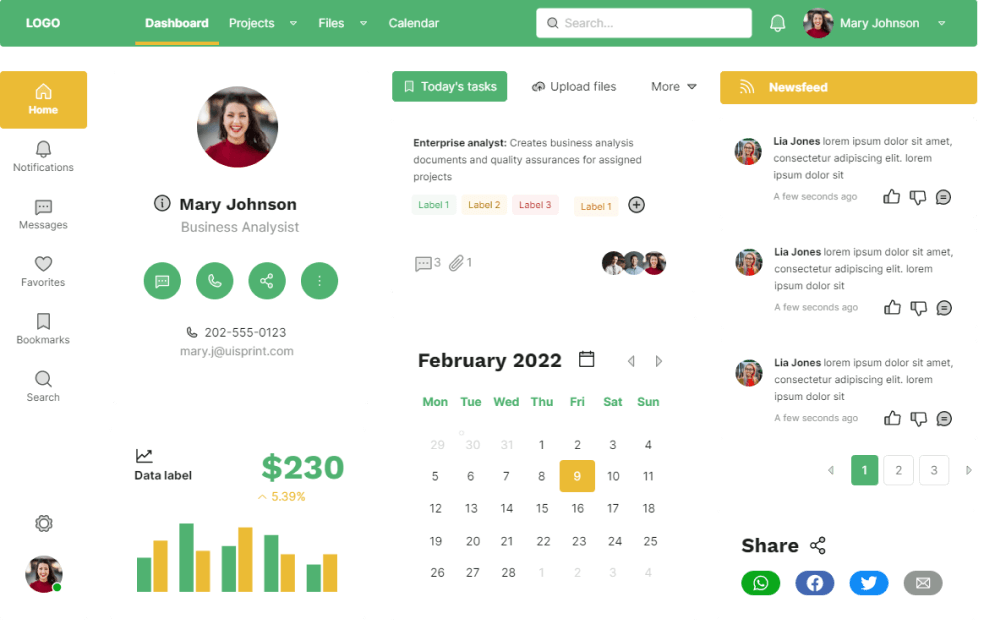

Templates are

themable

themable

Selected templates are automatically customized with your project theme, resulting in a unique design of your own.

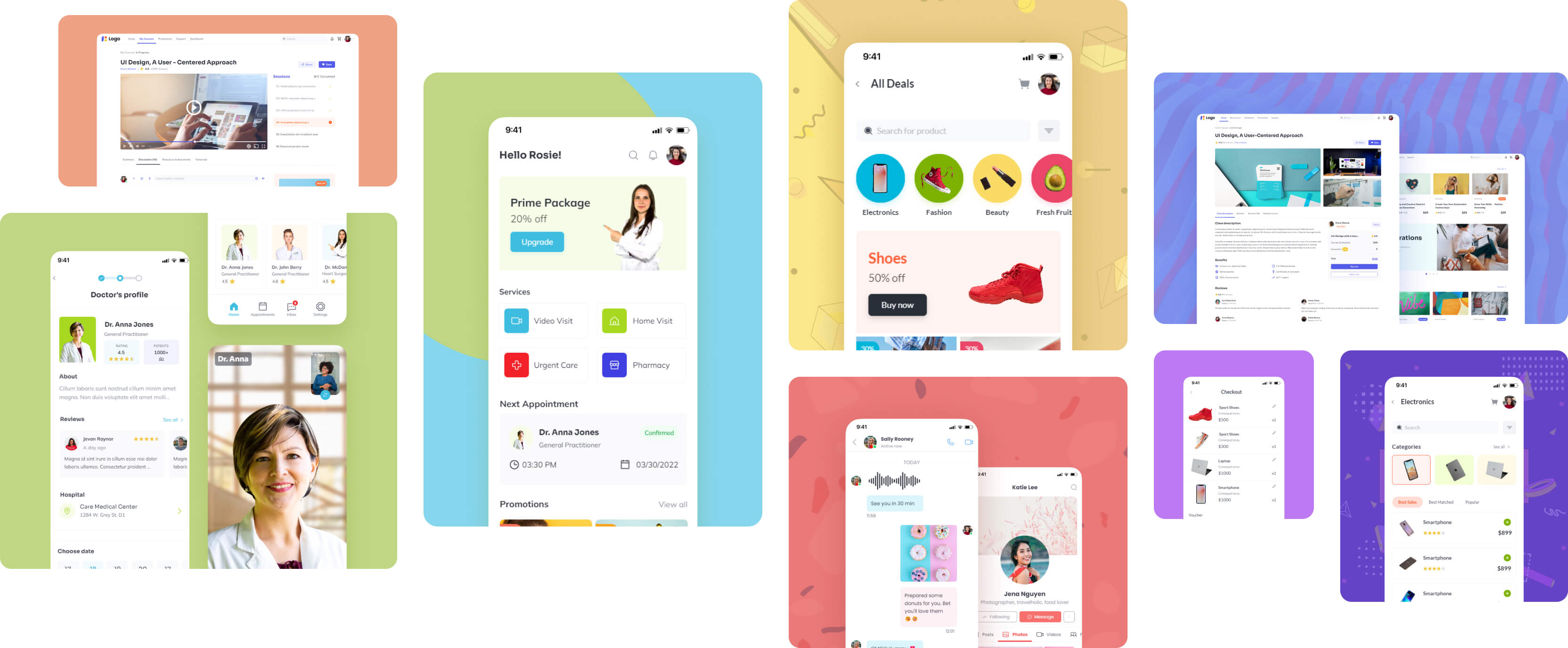

Available in

multiple screen sizes

Templates are available in different screen sizes for your app.

Quickly design your app for desktops, mobiles & tablets.

Quickly design your app for desktops, mobiles & tablets.

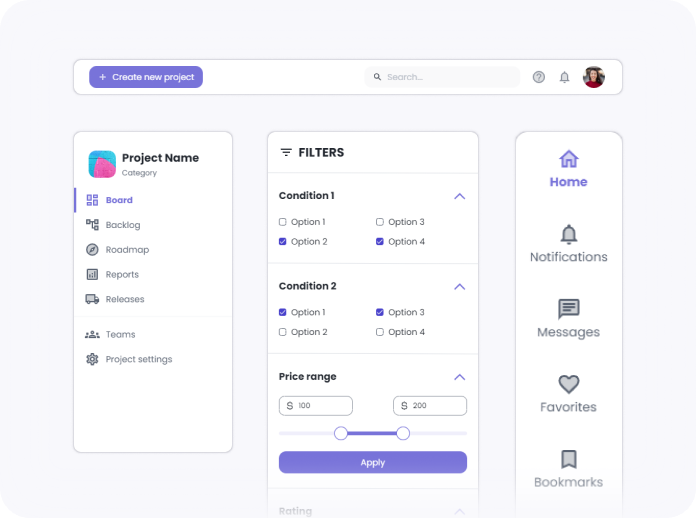

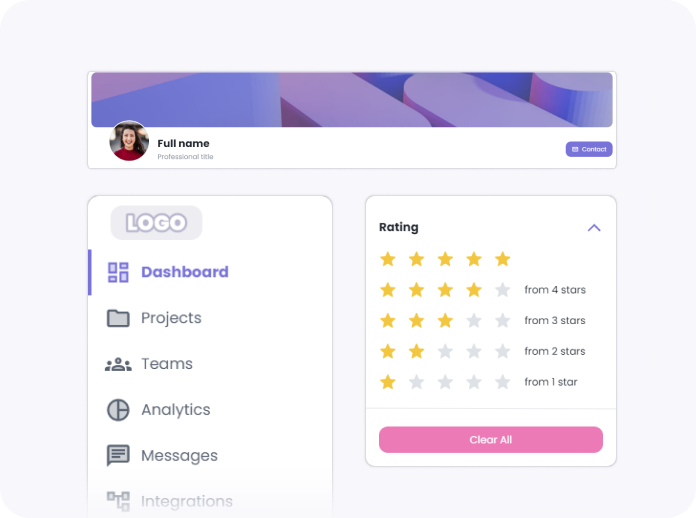

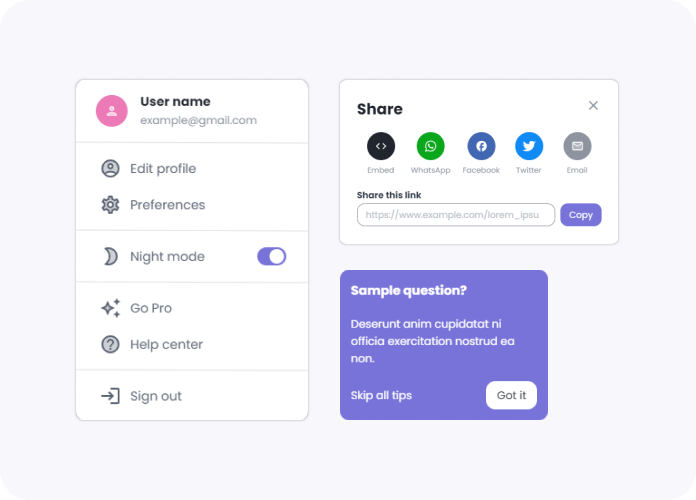

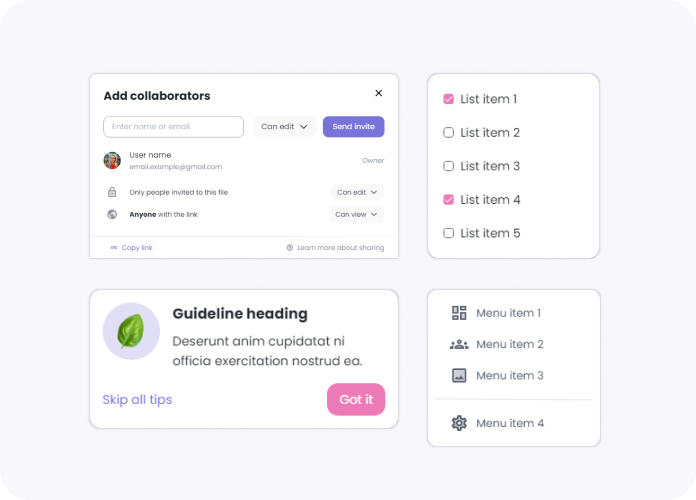

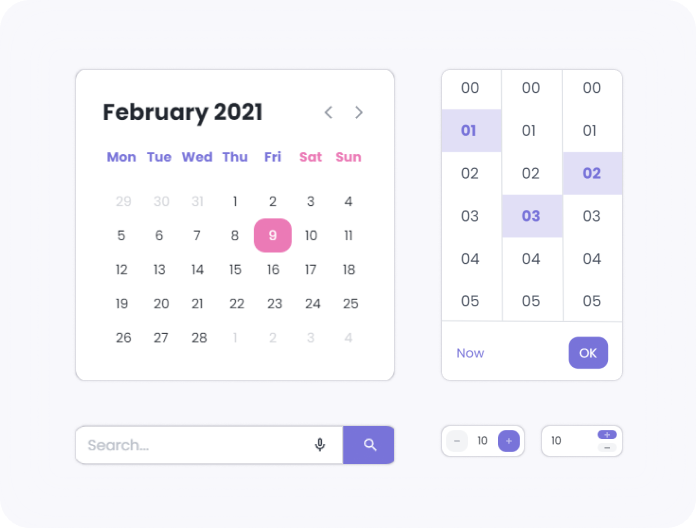

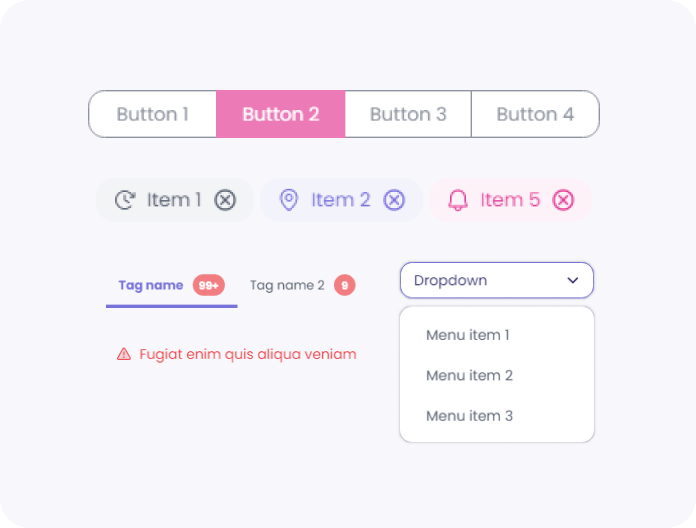

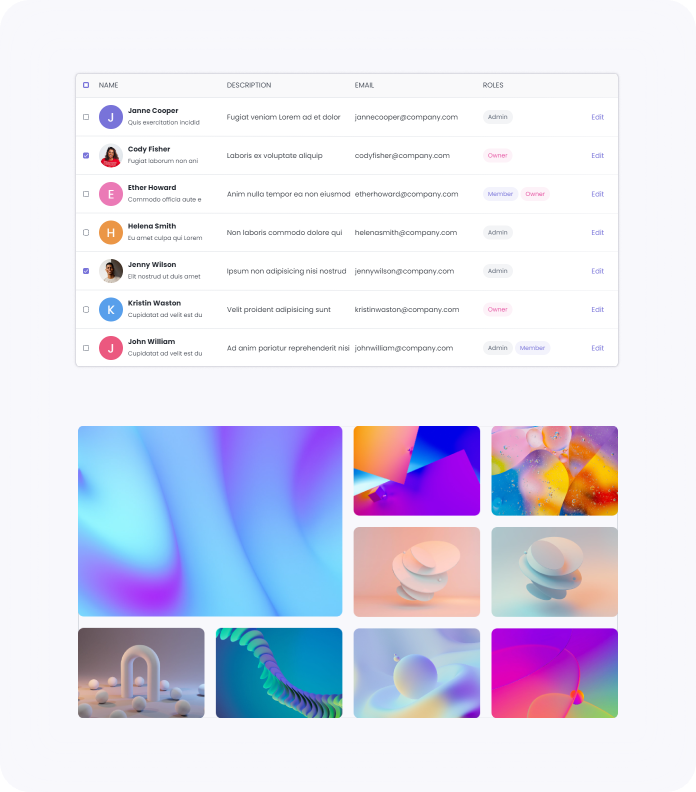

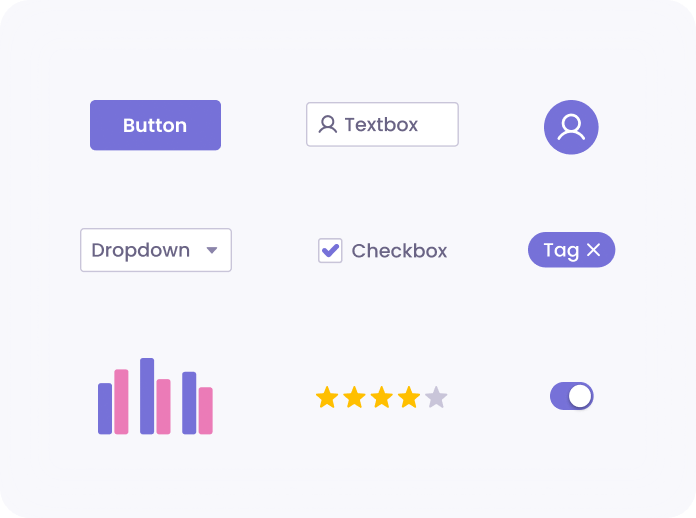

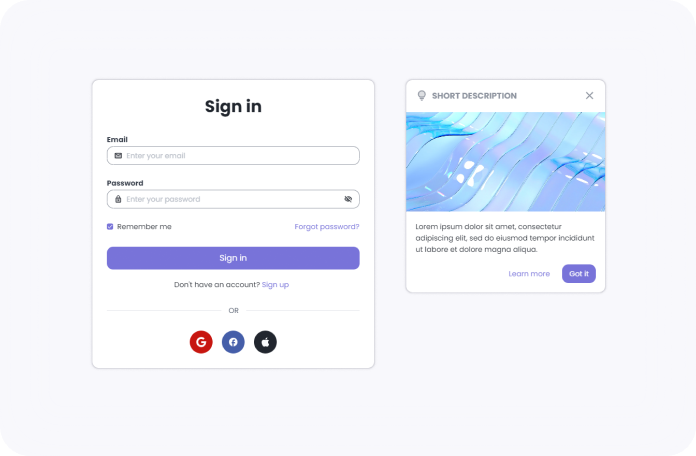

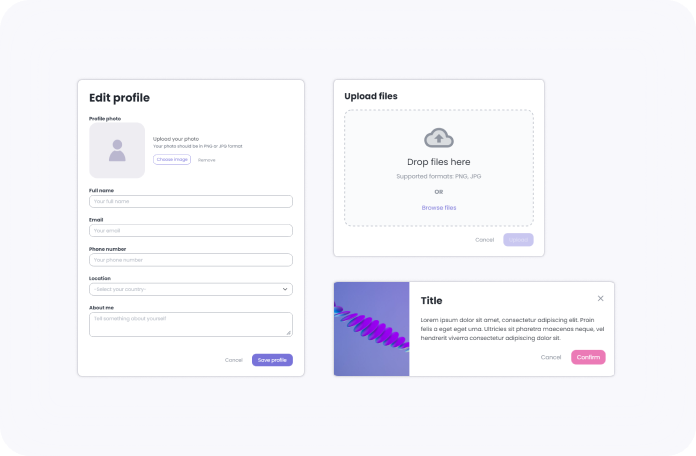

And hundreds of

component templates

component templates

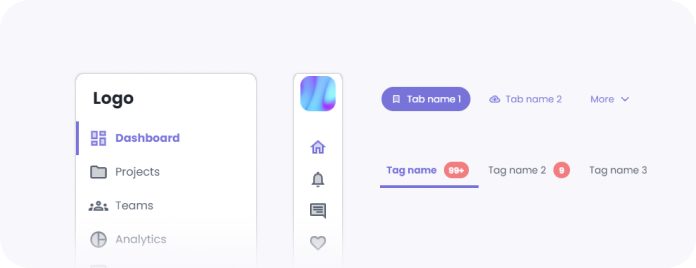

Headers & Sidebars

Menus & Popups

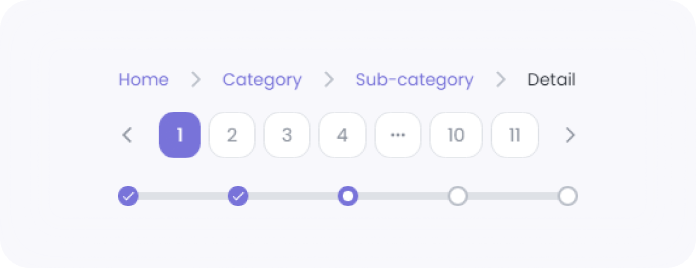

Form Controls

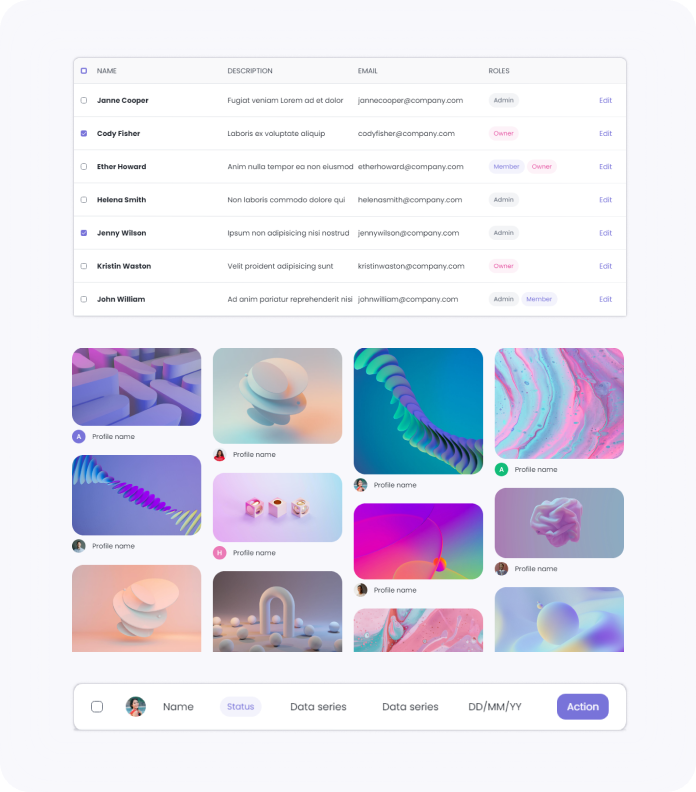

Tables & Lists

Navigation

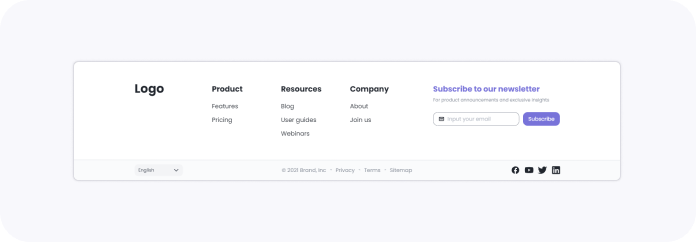

Footers

Smart Components

Forms & Dialogs

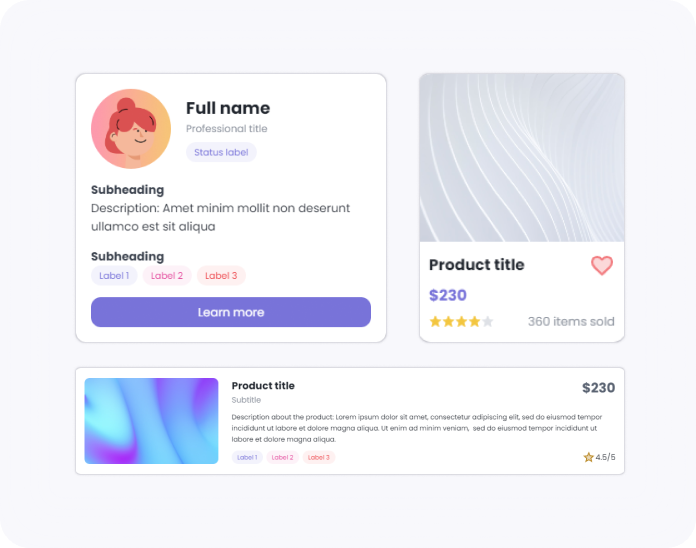

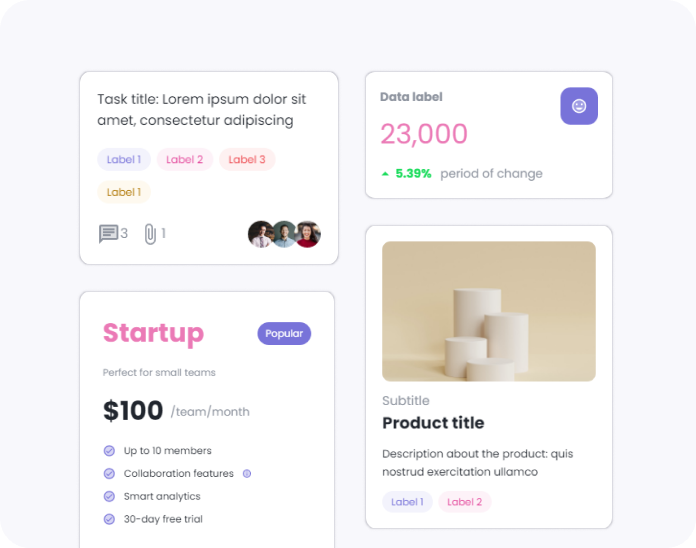

Cards

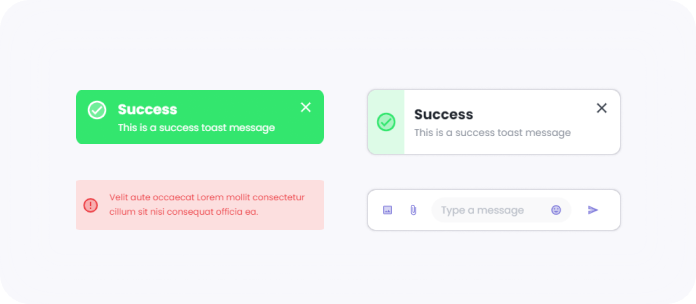

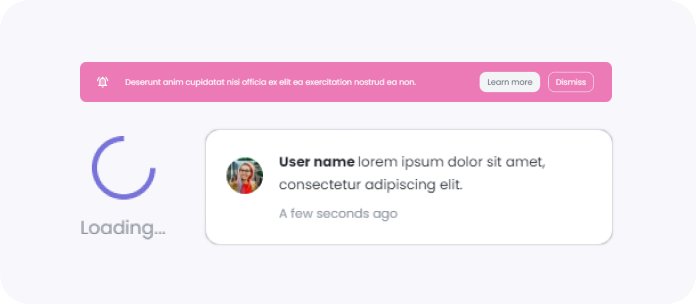

Alerts & Messages

Others

Hundreds of beautiful web and mobile app templates

No design skills needed!

No credit card required