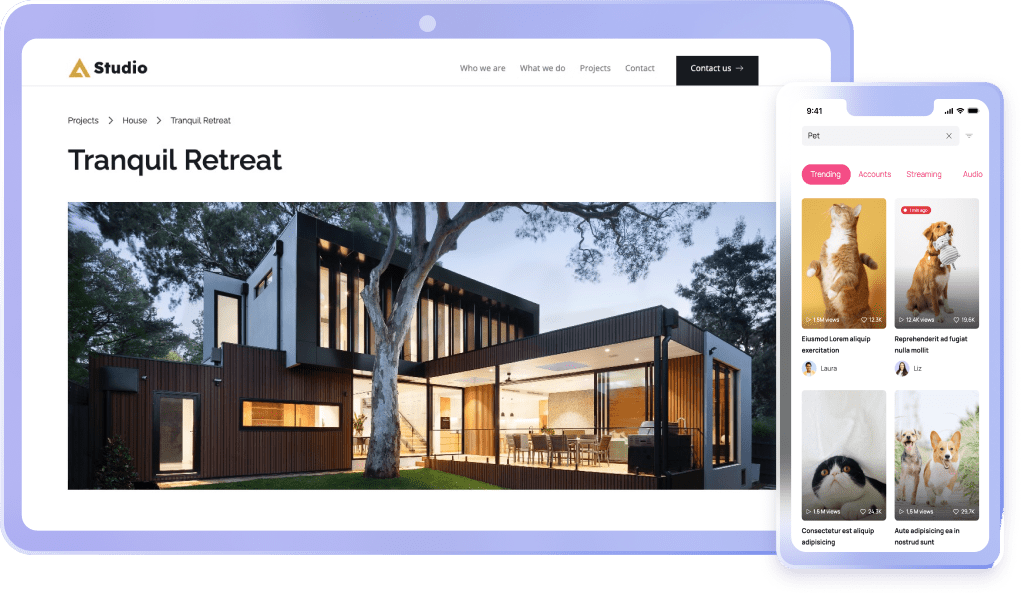

Audio Listening Flow App Template

Use Visily's Audio Listening Flow App Template and customize it the way you want

Make Your Audiobook Experiences Restive with Our Audio Listening Flow App Template

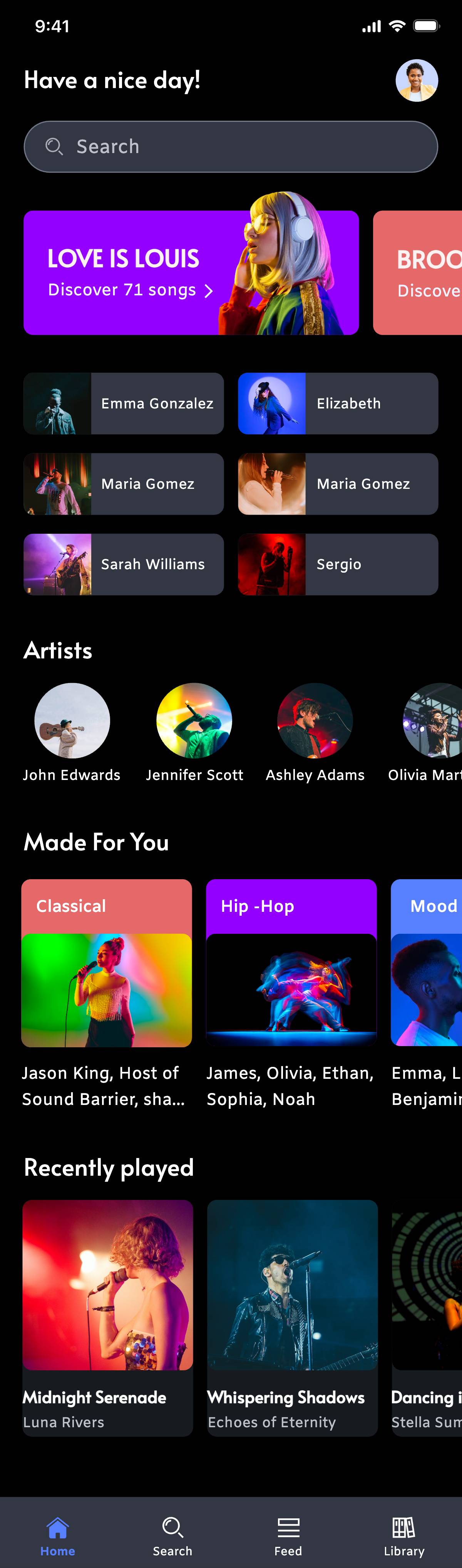

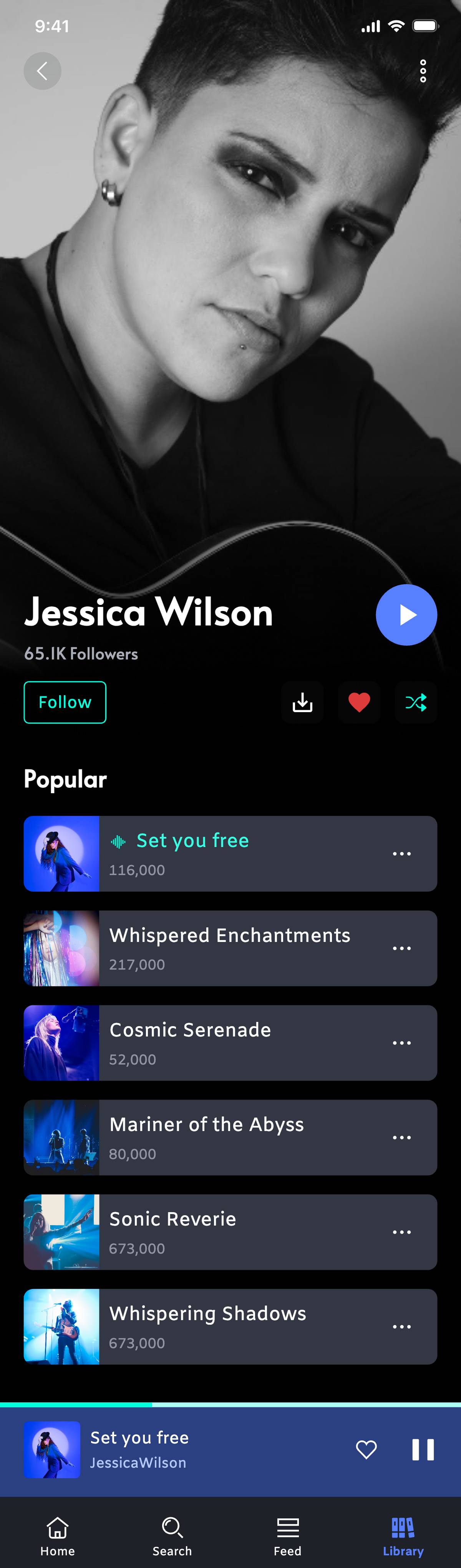

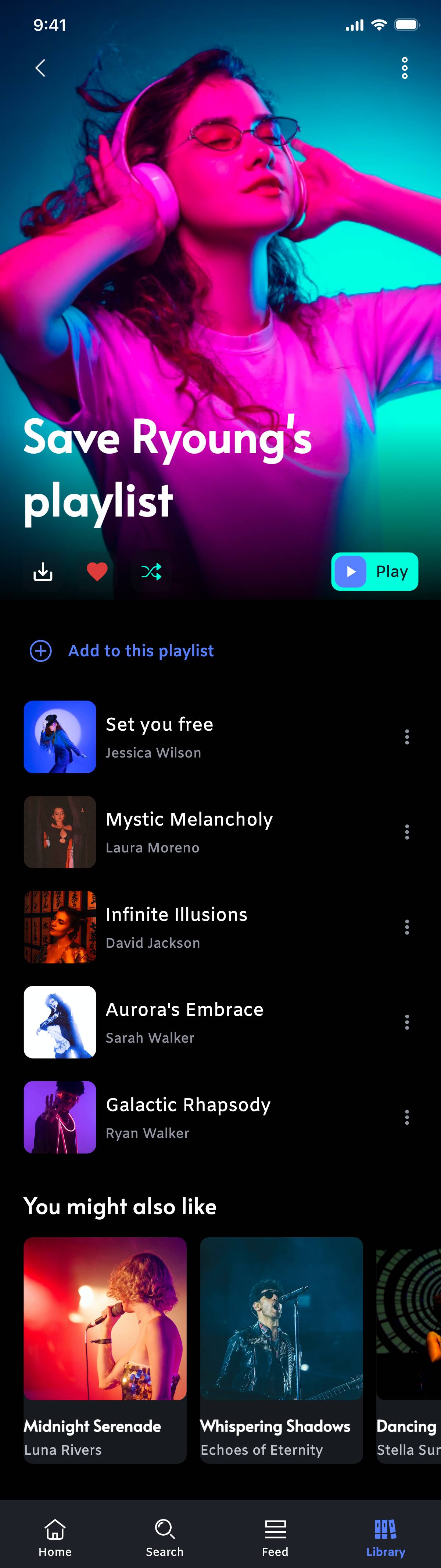

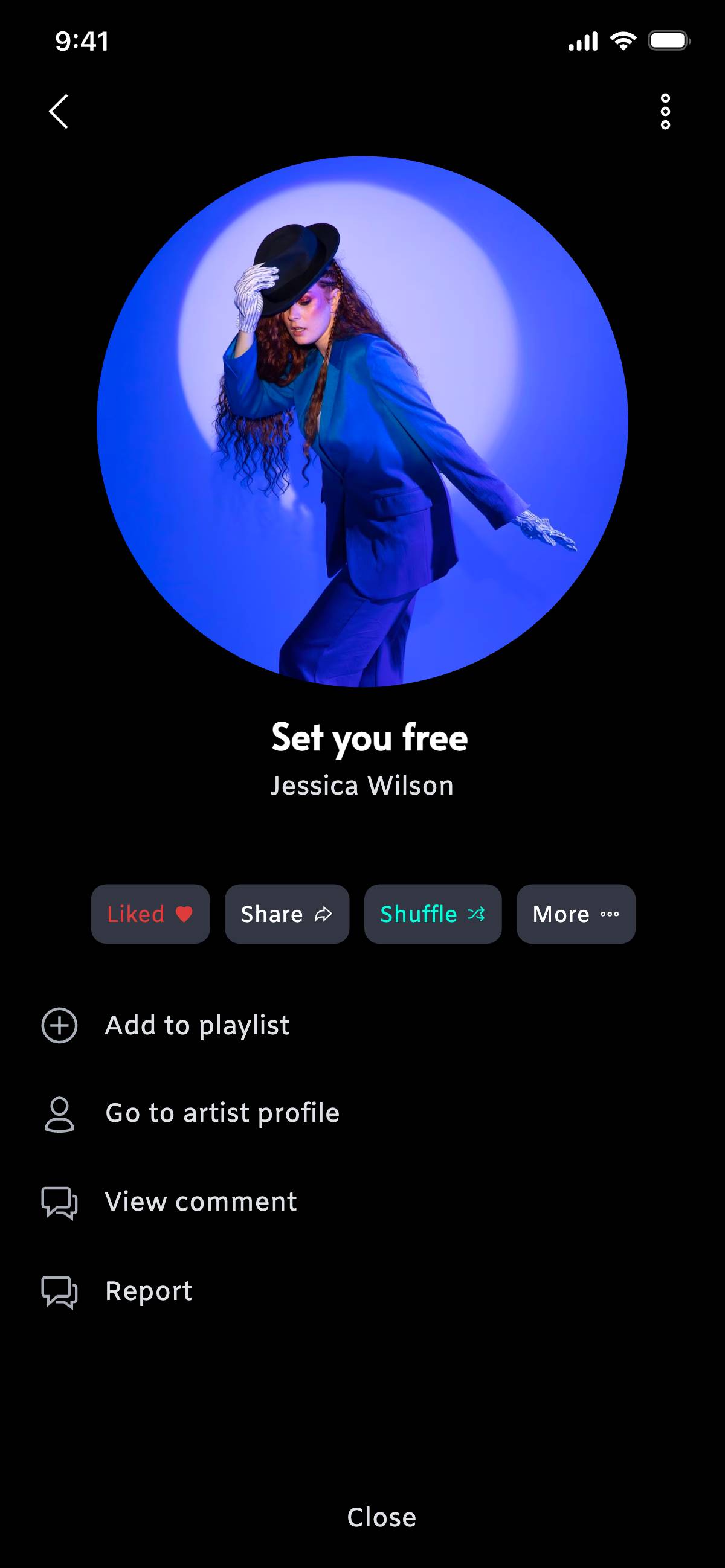

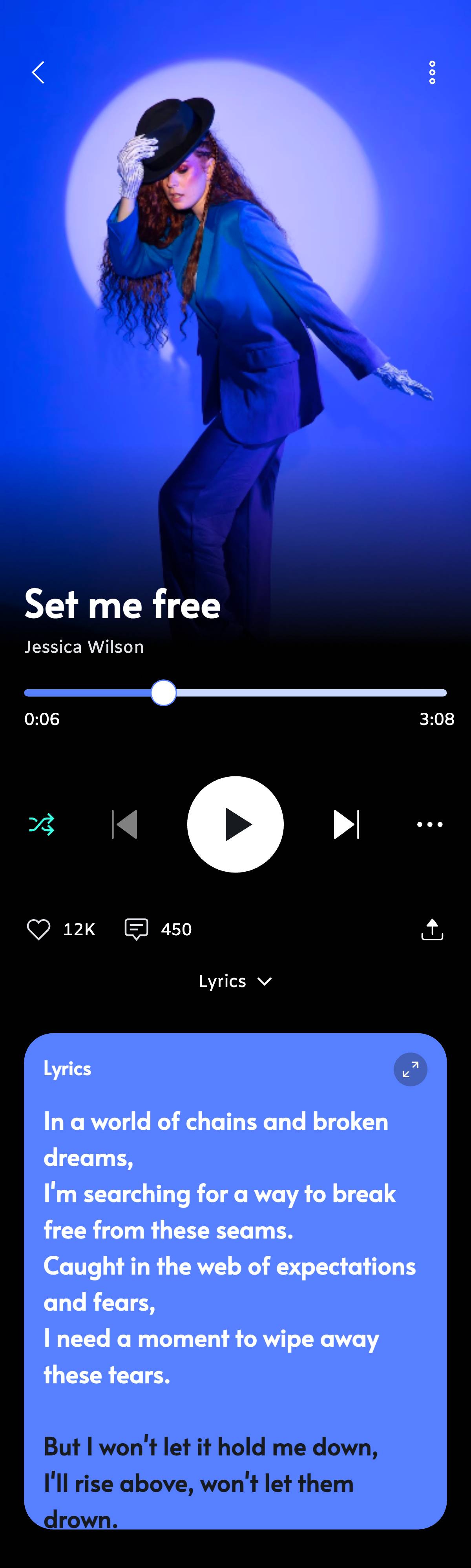

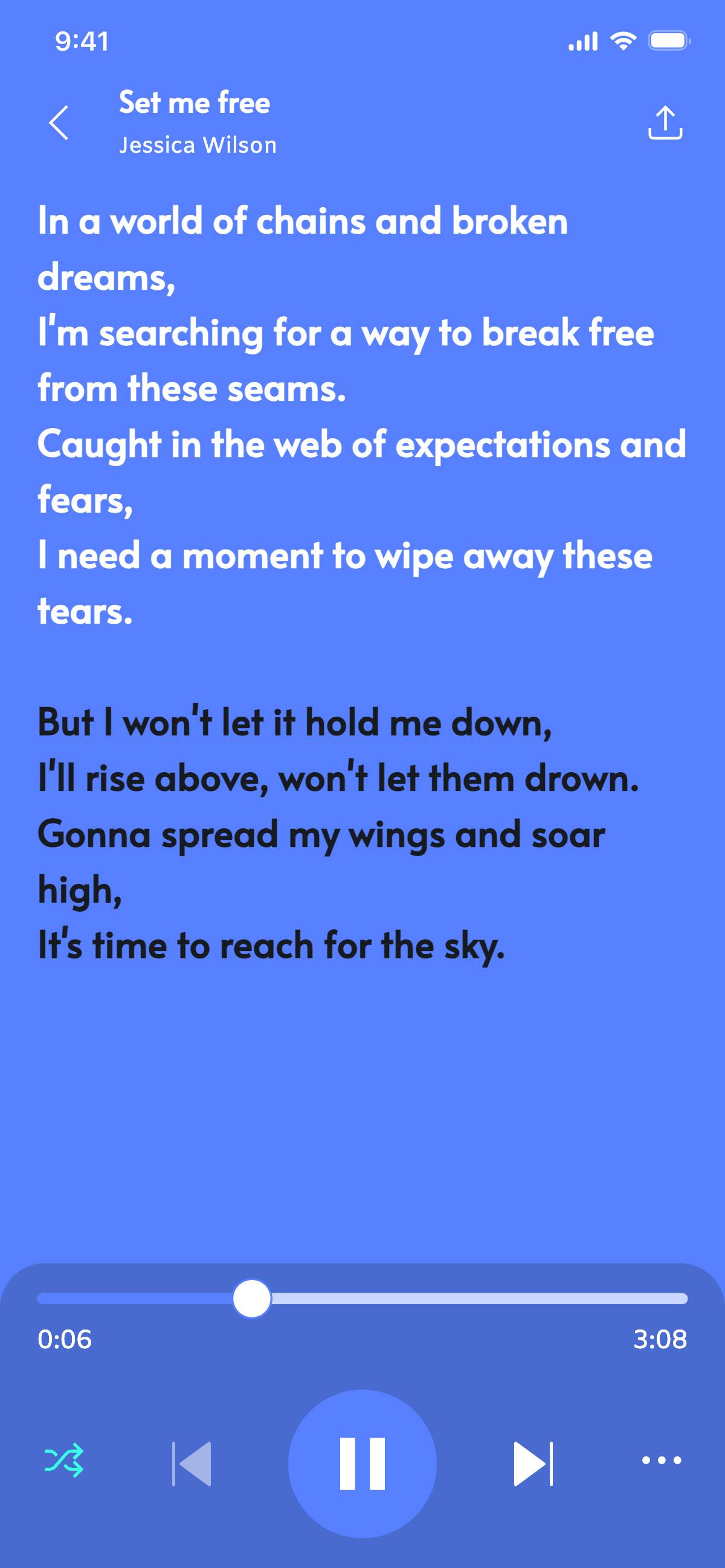

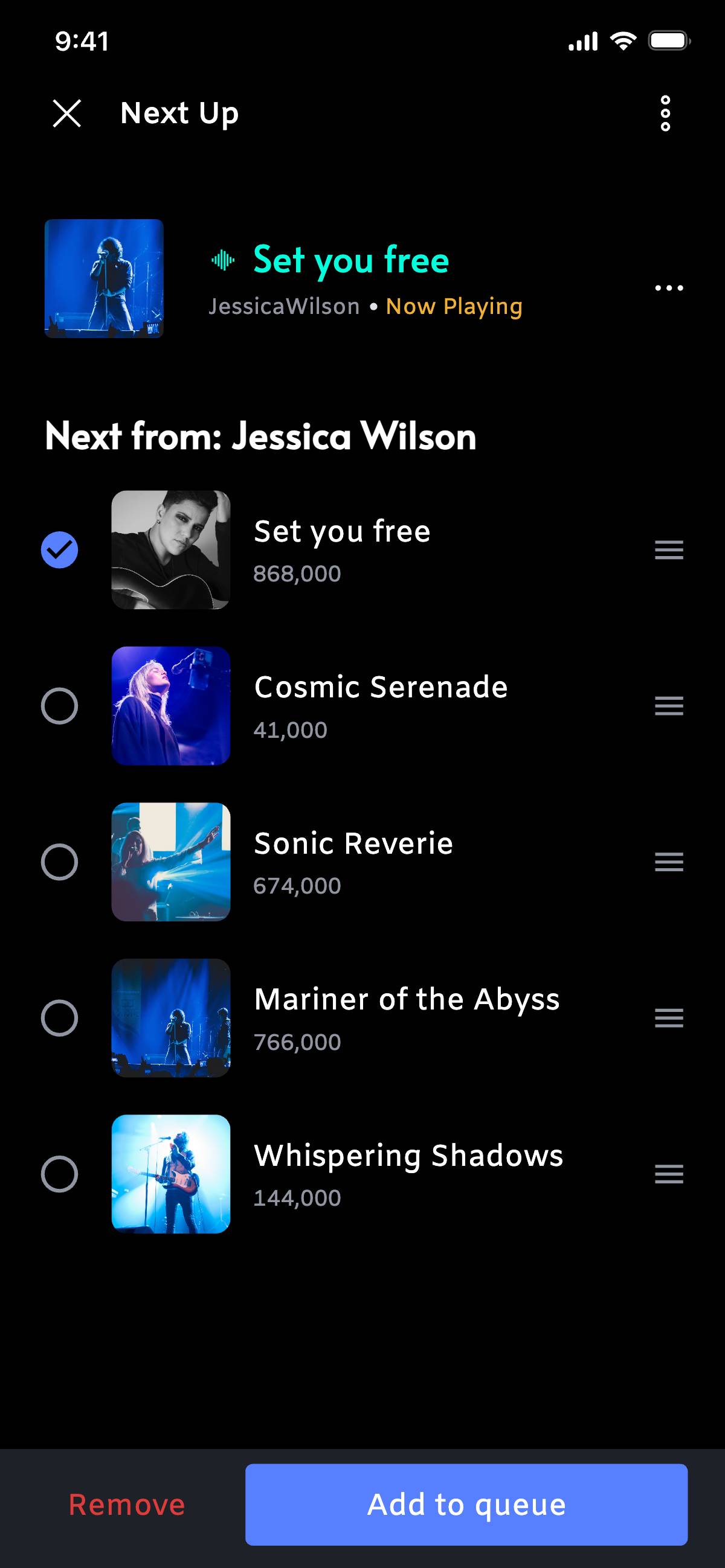

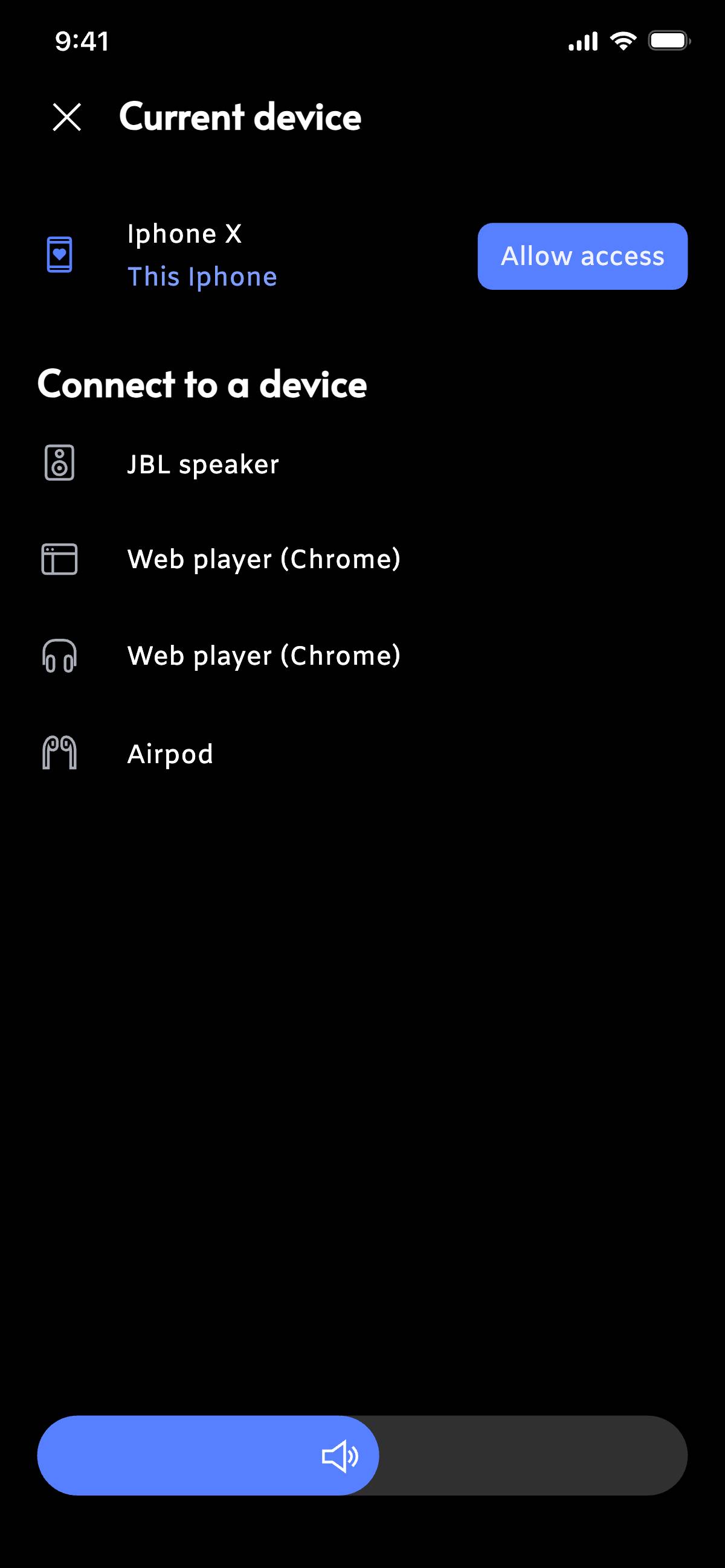

Boost the appeal of your audiobook app design project using our distinctive Audio Listening Flow App Template from Visily. Ideal for anyone looking to develop an audiobook, podcast, or music streaming app, this template furnishes you a robust base to kickstart your unique project.

Why Choose Visily's Audio Listening Flow App Template?

Tailor-Made App Designs

Our template offers a pliable interface which you can personalize according to your preferences. Pick from either a slick minimalist look or a more vibrant, artistic design to fit your brand needs with our fully customizable template.

Accelerate Your Development Process

Avoid beginning from zero, instead, leverage our pre-configured template to hasten your app creation process. Crafted with caution, our template elements like user-friendly navigation and attractive graphics offer an unbeatable user experience and a pleasing design. Expedite your launch by utilizing our template and focusing more on optimizing your application's core functions.

Harmonize Your Design with Your Brand

You can conveniently tweak colors, fonts, and styles to reflect your brand identity accurately. The real deal is that this uniform alteration accomplishes consistency across all your app screens.

Best Practice Oriented Template

- Encompasses all typical workflows and screens necessary for an audio streaming app.

- Upholds uniformity in design across all screens and sections.

- Optimal user experience guaranteed with all elements in the template being chosen with users in mind.

How to Utilize Visily's Audio Listening Flow App Template?

1. Get started by clicking on the "Use this template" button.

2. Create a Visily account to gain complete access to all our customization offerings.

3. Once you are signed in, you will be guided to a design canvas already populated with the template, just waiting to be tailored.

4. You can now begin personalizing your design using Visily's user-friendly and dynamic editor.

Related templates

Create stunning designs in a click

Visily's combination of power and simplicity lets anyone design beautiful UI.